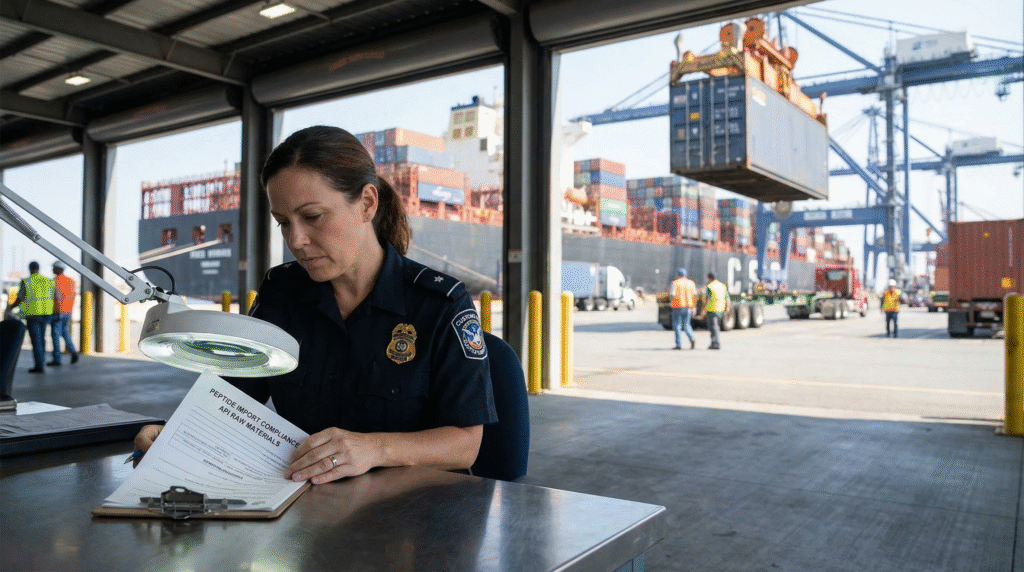

The global peptide therapeutics supply chain, valued at over $50 billion, is a complex web of international shipments where a single documentation error or regulatory oversight can trigger catastrophic delays, six-figure fines, and the destruction of temperature-sensitive cargo. With 40% of pharmaceutical companies reporting at least one significant customs hold for biological materials in the past 18 months, and average clearance delays costing $25,000 per day in lost trial momentum or sales, mastering import compliance is a non-negotiable core competency.

This definitive guide provides a strategic framework for navigating the intricate landscape of peptide importation, detailing the essential documentation, dissecting regional regulatory nuances, and outlining proactive compliance strategies to ensure your critical APIs, intermediates, and finished drugs move seamlessly across borders, protecting both your supply chain and your bottom line.

The High-Stakes World of Peptide Importation: Why Compliance is Strategic

Importing peptides is fundamentally different from shipping standard goods, involving layers of biological, chemical, and pharmaceutical regulations superimposed on standard customs procedures.

The Tangible Costs of Non-Compliance

Understanding the direct business impact of import failures:

- Financial Penalties: Customs fines for misclassification or missing permits can exceed $10,000 per shipment. DAO (Disposal, Abandonment, or Other) costs for seized goods add tens of thousands more.

- Operational Disruption: A 72-hour customs hold can derage a “just-in-time” manufacturing campaign, leading to factory downtime and missed product release dates.

- Product Loss: For cold-chain peptides, extended holds without proper storage can compromise stability and efficacy, forcing batch rejection. Lyophilized peptides are also sensitive to environmental conditions.

- Reputational Damage: Repeated compliance issues with a national authority (e.g., US FDA, EU customs) can flag your company for intensified scrutiny on all future shipments.

The Unique Challenges of Peptides as Regulated Articles

Factors that complicate the import process:

- Dual-Use and Controlled Substance Scrutiny: Certain peptide sequences or precursors may be subject to export/import controls (e.g., DEA schedules in the US, precursor regulations in the EU) due to potential misuse.

- Biological vs. Chemical Classification: Ambiguity in whether a peptide is classified as a “biological substance” or a “chemical” can drastically change the required permits and tariff codes.

- Temperature Control Documentation: Providing validated proof of maintained cold chain integrity from origin to destination is mandatory, requiring data loggers and detailed protocols.

- Varying National Regulations: A peptide API approved for import into the USA may require entirely different documentation for China or Brazil.

“Treating import compliance as a back-office logistics function is the single biggest mistake a peptide company can make. It is a strategic discipline that intersects regulatory affairs, supply chain management, and quality control. The document package accompanying your shipment is as critical as the purity of the API inside the vial.” — James Chen, Global Trade Compliance Director, AstraZeneca.

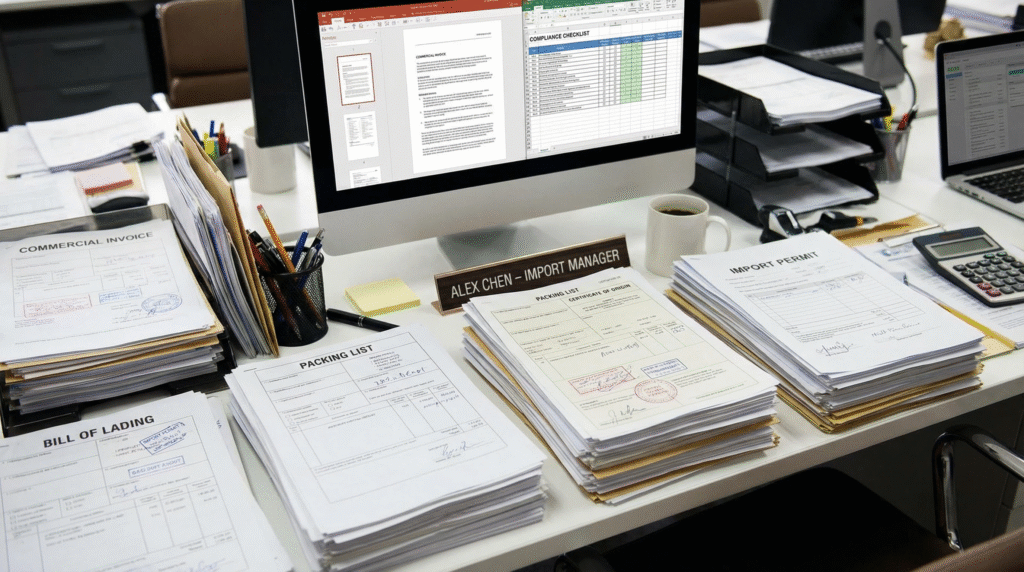

The Essential Documentation Suite: A Complete Checklist

Accurate and complete documentation is the passport for your peptide shipment. Missing or incorrect information is the primary cause of delays.

Core Commercial and Transport Documents

Standard shipping documents that require pharma-specific precision:

| Document | Purpose & Key Details for Peptides | Common Pitfalls |

|---|---|---|

| Commercial Invoice | Declares value for customs. Must include: precise product description (e.g., “Glycerol, Peptide API, 98.5% purity”), Harmonized System (HS) code, INCOTERMS, value per unit and total, manufacturer’s name and address. | Using vague descriptions like “chemical” or “research sample”; incorrect valuation that doesn’t match the proforma invoice. |

| Packing List | Details physical contents. Must list: number of containers, weight (gross, net, tare), exact quantities in milligrams/grams, storage conditions required (e.g., “Store at -20°C”). | Quantity mismatch with invoice; failing to note if dry ice or other refrigerants are used as cooling agents. |

| Air Waybill (AWB) or Bill of Lading (B/L) | Contract of carriage. Must clearly state: “PERISHABLE,” “KEEP FROZEN” or “KEEP COOL,” and the 24/7 contact details of a knowledgeable technical person. | Generic handling instructions; contact person unable to answer regulatory or technical queries from authorities. |

| Certificate of Origin | Determines applicable tariffs and trade agreement eligibility. May need to be issued by a local Chamber of Commerce. | Not obtained when required for preferential tariff treatment under agreements like USMCA. |

Specialized Pharmaceutical and Regulatory Documents

The critical differentiators for peptide shipments:

- Certificate of Analysis (CoA): The most scrutinized document. Must be batch-specific, from the qualified manufacturer, and include critical quality attributes (purity, related substances, residual solvents, endotoxin levels). It should be signed and dated.

- Material Safety Data Sheet (SDS) / Safety Data Sheet (SDS): Required for hazardous materials classification. For peptides, this often applies if shipped with flammable solvents or as a hazardous powder.

- Manufacturer’s Authorization / Free Sale Certificate: A document from the health authority in the country of origin stating the manufacturing site is approved and, for finished drugs, that the product is legally marketed there. Crucial for many emerging markets.

- Import License / Permit: Many countries require a pre-approval from their national health authority (e.g., India’s Import Permit, Saudi Arabia’s SFDA certificate) before the peptide can even be shipped.

- Power of Attorney (POA): Often required by customs brokers in the destination country to act on the importer’s behalf. Must be on company letterhead.

Cold Chain and Stability Documentation

Evidence to prove product integrity during transit:

- Qualified Thermal Packaging Validation Report: Documentation proving the shipper (e.g., VIP, parcel) maintains the required temperature range for the declared transit time.

- Temperature Data Logger Report: A summary from the data logger device inside the shipment, showing the temperature was maintained throughout transit. The full data file should be available upon request.

- Stability Data Reference: Reference to the peptide’s stability profile (e.g., “Stable for 72 hours at 2-8°C per stability study PRO-123”) justifying the chosen transport conditions.

Navigating Key Regulatory Regimes: A Regional Breakdown

Regulatory requirements are not global. A proactive strategy understands the major destination markets.

United States (FDA & Customs and Border Protection – CBP)

- Prior Notice to FDA: Must be submitted electronically for all human and animal drugs (including APIs) at least 8 hours before arrival by air. Includes manufacturer, product, and FDA registration details.

- FDA Registration: The foreign manufacturer of the peptide API must be registered with the US FDA, and the product must be listed.

- Customs Bond: A continuous bond is typically required for frequent commercial imports.

- DEA Requirements: If the peptide is a controlled substance (e.g., certain analgesic peptides), an import permit from the DEA is mandatory.

European Union (EMA & National Competent Authorities)

- Active Substance Master File (ASMF) / CEP Reference: For APIs, a reference to a submitted ASMF or a Certificate of Suitability (CEP) from EDQM is often used to demonstrate quality.

- Written Confirmation: For APIs imported from many non-EU countries, a “Written Confirmation” from the local health authority is required, stating GMP compliance equivalent to EU standards.

- Importation of Active Substances for Medicinal Products (Directive 2011/62/EU): Requires importers of APIs to be registered with their national competent authority.

China (NMPA & Customs)

- Import Drug License: A complex, pre-approval process required for most APIs and all finished drugs. Obtaining it can take 12-18 months.

- Good Importation Practice (GIP) Certificate: The Chinese importer must hold a GIP certificate.

- Mandatory Testing: Many peptide APIs are subject to mandatory testing by the National Institutes for Food and Drug Control (NIFDC) upon arrival, which can add weeks to the release timeline.

Proactive Compliance Strategies and Best Practices

Moving from reactive firefighting to a streamlined, predictable import process.

Building a Robust Internal Process

- Designate a Compliance Owner: A single point of responsibility (internally or a dedicated broker) for all peptide imports ensures consistency and accountability.

- Develop Master Import Documentation Packets: Create standardized, pre-approved templates for core documents (commercial invoice, packing list) specific to each major product and destination.

- Conduct Pre-Shipment Audits: Implement a mandatory checklist review of the entire document package against the destination country’s requirements before the shipment is released from the supplier.

- Invest in Trade Compliance Software: Use software to manage HS code classification, denied party screening, and document generation to reduce human error.

Cultivating Strategic External Partnerships

- Select a Specialized Pharma Freight Forwarder & Broker: Partner with agents who have proven experience in pharmaceutical imports, not general cargo. They understand cold chain, FDA processes, and bond requirements.

- Engage Regulatory Consultants for New Markets: Before entering a new country (e.g., Brazil, Saudi Arabia), invest in a regulatory assessment to identify all permit, testing, and labeling requirements.

- Harmonize with Your Supplier: Work with your peptide manufacturer to ensure they can provide all necessary documentation (e.g., specific CoA format, Free Sale Certificate) in a timely manner.

Future Trends: Digitalization and Increasing Scrutiny

The landscape of import compliance is becoming more complex and technologically driven.

Digital and Predictive Compliance

- Electronic Data Interchange (EDI) and Blockchain: Adoption of EDI for customs declarations and pilot use of blockchain for immutable CoA and temperature data sharing to speed up clearance.

- Artificial Intelligence for Classification: AI tools are emerging to help classify complex peptides under the correct HS code, reducing a major source of error.

- Predictive Analytics for Risk: Using data to predict which shipments are likely to be inspected based on origin, product, and importer history.

Evolving Regulatory Headwinds

- Increased Scrutiny of Chinese and Indian APIs: Geopolitical tensions are leading to more inspections and sampling of APIs from certain regions by US and EU authorities.

- Environmental, Social, and Governance (ESG) Factors: Future regulations may require documentation on the carbon footprint of the shipment or sustainable sourcing of raw materials.

- Serialization and Traceability: Requirements for unique identifiers on drug products (like the EU FMD) will eventually extend deeper into the API supply chain, requiring more granular shipment data.

FAQs: Peptide Import Compliance

Q: What is the single most common mistake that causes peptide shipments to be held in customs?

A: The most common critical error is an incomplete or mismatched Certificate of Analysis (CoA). This includes: a CoA that is not batch-specific to the shipped material; missing signatures or dates; quality specifications (e.g., purity) that do not align with the product description on the commercial invoice; or the use of a CoA from a distributor rather than the actual manufacturer. Customs and health authorities view the CoA as the definitive proof of what the substance is and its quality. Any discrepancy raises red flags about product authenticity and safety, triggering an immediate hold for investigation, which can involve lengthy product testing.

Q: How far in advance should we start preparing documentation for a new peptide import to a country we haven’t used before?

A: For a first-time import to a new regulatory jurisdiction, you should initiate the compliance process at least 90-120 days before your target shipment date. The timeline is driven by permit applications (e.g., an Import Drug License for China can take 12+ months), obtaining manufacturer certifications (e.g., a Written Confirmation for the EU), and potentially pre-shipment testing requirements. Rushing this process almost guarantees delays. The first step should always be a regulatory intelligence gathering exercise, often with a local consultant, to map all requirements.

Q: For a small biotech with infrequent, high-value peptide API imports, is it better to handle compliance in-house or outsource it?

A: For an SME with infrequent but critical shipments, outsourcing to a specialized pharma freight forwarder and customs broker is almost always the most effective and low-risk strategy. The upfront cost is justified by avoiding a single catastrophic error. These experts maintain updated knowledge of changing regulations, have relationships with customs officials, and can manage the complex documentation and bonding requirements.

Your internal role should be one of oversight and information provision: you must provide the broker with absolutely accurate and complete technical information about the product (CoA, structure, use) and ensure a strong quality agreement is in place with your supplier to mandate their documentary support.

Core Takeaways

- Documentation is King: A perfect, consistent, and complete document package is the primary determinant of smooth customs clearance for peptides. The CoA is the most critical component.

- Proactivity Beats Reactivity: Investing in pre-shipment compliance checks, market-specific regulatory research, and partner qualification prevents far more cost and delay than reacting to a crisis at the border.

- Regulations are Local, Not Global: There is no universal standard. Success requires understanding and preparing for the specific requirements of the destination country’s health and customs authorities.

- Cold Chain is a Documentation Challenge: Proving temperature integrity requires as much documentation (validation reports, data logger summaries) as it does physical packaging excellence.

- Specialized Expertise is Non-Negotiable: Whether built in-house or outsourced, dedicated knowledge of pharmaceutical import regulations is essential and should be treated as a strategic investment, not a cost.

Conclusion: Building a Frictionless Global Supply Chain

Mastering peptide import compliance is a demanding discipline that sits at the critical intersection of regulatory science, logistics, and global trade law. In an industry where time-to-clinic and time-to-market are paramount, the ability to reliably move sensitive biological materials across borders is a formidable competitive advantage. By adopting a systematic, document-centric, and partnership-driven approach, companies can transform import logistics from a recurring source of risk into a pillar of supply chain reliability.

The future will demand even greater transparency, digitization, and agility. Organizations that build robust compliance frameworks today will be best positioned to navigate increasing regulatory complexity and leverage new technologies, ensuring that their innovative peptide therapies reach patients worldwide without unnecessary delay or compromise.

Disclaimer

This article contains information, data, and references that have been sourced from various publicly available resources on the internet. The purpose of this article is to provide educational and informational content. All trademarks, registered trademarks, product names, company names, or logos mentioned within this article are the property of their respective owners. The use of these names and logos is for identification purposes only and does not imply any endorsement or affiliation with the original holders of such marks. The author and publisher have made every effort to ensure the accuracy and reliability of the information provided.

However, no warranty or guarantee is given that the information is correct, complete, or up-to-date. The views expressed in this article are those of the author and do not necessarily reflect the views of any third-party sources cited.