The global peptide therapeutics supply chain, valued at over $50 billion, is navigating an increasingly complex and costly trade landscape where import duties can constitute 5-20% of the total landed cost of critical Active Pharmaceutical Ingredients (APIs), intermediates, and finished drugs. With over 350 active regional trade agreements worldwide and the average peptide manufacturer qualifying for—but not utilizing—duty savings programs on 30-40% of their imports, a strategic approach to duty optimization represents an immediate, tangible opportunity to unlock millions in annual savings and bolster competitive advantage.

This comprehensive guide demystifies the process of leveraging Free Trade Agreements (FTAs), preferential trade programs, and intelligent customs classification to transform import duties from a fixed cost center into a manageable, optimized component of the total supply chain, ensuring peptide innovations reach patients efficiently and affordably.

The High Cost of Inaction: Duty as a Manageable Supply Chain Variable

For peptide companies, import duties are often treated as an unavoidable tax, but in reality, they are a dynamic cost subject to strategic management and significant reduction.

The Direct Financial Impact of Unoptimized Duties

Understanding the scale of the opportunity:

- Duty Rates on Peptide Products: Can range from 0% to 6.5% in the US, 0% to 6.5% in the EU, and vary significantly in emerging markets, often with higher rates for finished drugs versus APIs.

- Cumulative Cost: For a company importing $50 million annually in peptide materials, a 5% average duty equals $2.5 million in annual expense—a direct hit to the bottom line.

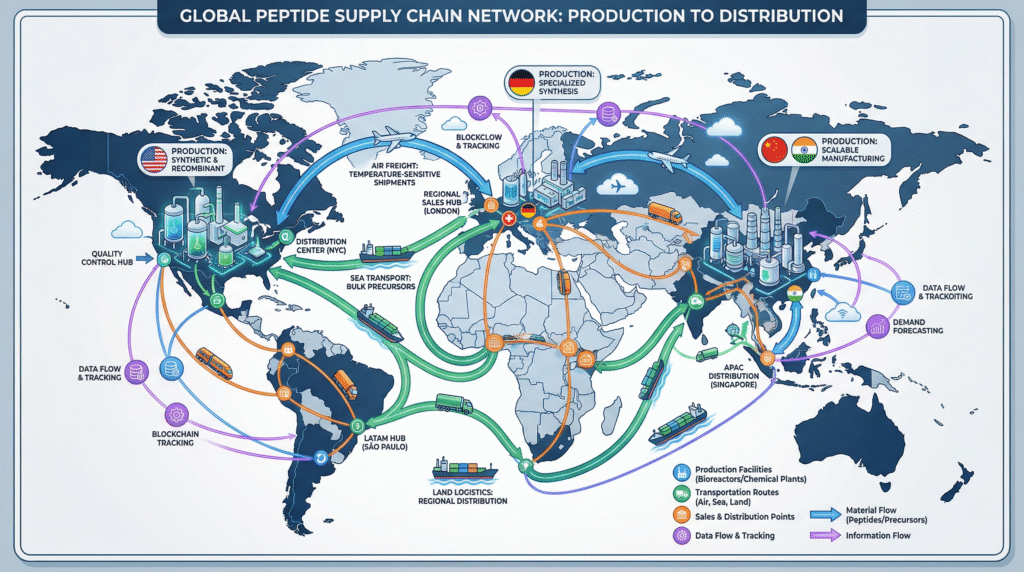

- Amplified by Supply Chain Complexity: Multi-country manufacturing (e.g., API from China, formulation in the EU, filling in the US) can result in multiple duty events, magnifying the total cost.

Beyond Direct Savings: The Strategic Value of Optimization

Duty optimization delivers broader business benefits:

- Enhanced Competitiveness: Lower landed costs improve margins or allow for more competitive pricing.

- Supply Chain Resiliency: Understanding trade agreements can identify alternative sourcing regions with preferential access, reducing dependency on single geographies.

- Improved Cash Flow: Programs like duty drawback (refunds on duties paid for re-exported goods) and foreign-trade zones (FTZs) defer or eliminate duty payments, freeing up working capital.

- Investor & Stakeholder Confidence: Demonstrating sophisticated global trade management is a marker of operational excellence and robust governance.

“Treating import duties as a line item on a freight invoice is a $10 million mistake waiting to happen. In peptide manufacturing, where margins are fought for in basis points, a comprehensive duty optimization strategy isn’t a tax function—it’s a core component of procurement and supply chain strategy that directly protects profitability and fuels growth.” — Elena Vasquez, Global Head of Trade and Customs, Pfizer CentreOne.

The Foundation: Accurate Classification and Valuation

Effective optimization is built on two non-negotiable pillars: correct Harmonized System (HS) codes and proper customs valuation.

Mastering Harmonized System (HS/Tariff) Codes

The HS code is the universal language of international trade and the key to unlocking correct duty rates and agreement eligibility.

| Product Type | Example HS Code (U.S. HTSUS) | Chapter/Heading | Classification Challenge |

|---|---|---|---|

| Peptide APIs | 2937.99.0800 | 29.37: Hormones, peptides | Distinguishing between “peptides” and “proteins” (which fall under heading 35.07) based on molecular weight and structure. |

| Amino Acids for Synthesis | 2922.49.3000 | 29.22: Oxygen-function amino-compounds | Specific classification of protected (e.g., Fmoc-) versus unprotected amino acids. |

| Finished Injectable Peptides | 3004.32.0000 | 30.04: Medicaments, therapeutic | Determining if presented in measured doses or in bulk form for retail sale. |

Best Practice: Secure a binding ruling from the destination country’s customs authority (e.g., U.S. Customs Ruling Online Search System – CROSS) for critical products to ensure certainty and avoid future penalties.

Ensuring Proper Customs Valuation

The duty amount is the duty rate multiplied by the customs value. Incorrect valuation triggers penalties.

- Transaction Value Method: The price actually paid or payable for the goods, plus certain additions (e.g., packing costs, selling commissions, royalties).

- Transfer Pricing Alignment: For related-party transactions (e.g., imports from a company’s own manufacturing subsidiary), the declared value must align with arm’s length principles per OECD guidelines and be well-documented.

- Common Pitfall: Incorrectly excluding assists (e.g., molds, tools, engineering work provided free of charge to the foreign manufacturer) from the declared value.

The Engine of Savings: Leveraging Free Trade Agreements (FTAs)

FTAs are treaties between countries that reduce or eliminate tariffs on goods that meet specific Rules of Origin (ROO).

Key FTAs Relevant to Peptide Supply Chains

| Trade Agreement | Member Regions (Examples) | Potential Duty on Peptides | Strategic Implication |

|---|---|---|---|

| USMCA (U.S.-Mexico-Canada Agreement) | USA, Mexico, Canada | 0% for qualifying goods | Enables duty-free North American peptide manufacturing and distribution networks. |

| EU-UK Trade and Cooperation Agreement (TCA) | European Union, United Kingdom | 0% for qualifying goods | Critical for maintaining tariff-free peptide trade post-Brexit. |

| Comprehensive and Progressive Agreement for Trans-Pacific Partnership (CPTPP) | Japan, Canada, Australia, Mexico, Singapore, etc. | Reduced rates, often trending to 0% | Creates a diversified Asia-Pacific sourcing and market access bloc. |

| Regional Comprehensive Economic Partnership (RCEP) | China, Japan, South Korea, Australia, ASEAN | Reduced rates over time | Simplifies rules for complex Asian peptide API supply chains. |

Navigating Rules of Origin (ROO)

ROO are the criteria determining the “economic nationality” of a good. To claim FTA benefits, your peptide must qualify as “originating.”

- Wholly Obtained or Produced: Rare for synthetic peptides, as starting materials (amino acids) are often globally sourced.

- Tariff Shift Rule: The most common test. Requires that the non-originating materials used in production undergo a sufficient change in tariff classification (e.g., amino acids transformed into a peptide API). The specific shift required is detailed in the FTA’s product-specific rules.

- Regional Value Content (RVC) Rule: Requires that a minimum percentage of the product’s value originate within the FTA region. Challenging for peptides with high-cost, non-originating Fmoc-amino acids.

- Documentation (Certificate of Origin): A formal document, often a self-certification by the exporter, is required to claim the preferential rate at import.

Beyond FTAs: Additional Duty Optimization Programs

A comprehensive strategy utilizes all available tools in the trade compliance toolkit.

Duty Drawback

A refund of 99% of duties paid on imported goods that are later exported (or destroyed) within a specified period.

- Direct Identification Drawback: Refund on duties paid on the specific imported material that was exported as part of a finished product. Complex record-keeping.

- Substitution Drawback: More flexible. Allows for a refund on duties paid on imported material if a commercially interchangeable domestic or imported material is used in the exported product. Highly valuable for peptide manufacturers using fungible amino acids or solvents.

Foreign-Trade Zones (FTZs) and Bonded Warehouses

Secure areas within a country that are considered, for customs purposes, to be outside its territory.

- Duty Deferral: Duties are not paid until goods are released from the zone into the domestic market. This can be years, improving cash flow.

- Duty Elimination on Exports: Goods imported, manufactured, and then re-exported from an FTZ never incur domestic duties.

- Inverted Tariff Relief: If the duty rate on finished goods is lower than on components, manufacturing in an FTZ allows the company to pay the lower finished goods rate.

Special Government Programs

- Miscellaneous Trade Bill (MTB) in the U.S.: Temporary duty suspensions or reductions on non-sensitive goods, including certain specific chemicals and pharmaceuticals. Requires application and congressional approval.

- Pharmaceuticals Initiative / Duty-Free Chemical Programs: Some countries have programs that allow duty-free import of designated pharmaceutical ingredients not available domestically.

Building a Proactive Duty Optimization Framework

Sustainable savings require a systematic, cross-functional process, not ad-hoc efforts.

Step-by-Step Implementation Roadmap

- Conduct a Duty Opportunity Assessment: Analyze 12-24 months of import data. Classify all products correctly, identify applicable FTAs for each source country, and calculate potential savings.

- Engage Suppliers on FTA Eligibility: Work with key API and raw material manufacturers to determine if products qualify under relevant FTAs and to secure proper Certificates of Origin.

- Review Supply Chain Design: Model total landed cost (including duties) for different sourcing and manufacturing footprints. Could shifting an intermediate step to an FTA partner country confer originating status?

- Implement Technology & Processes: Use global trade management (GTM) software to automate HS code classification, manage FTA certificates, and track eligibility. Integrate duty costs into the procurement decision matrix.

- Establish Continuous Monitoring: Trade agreements and duty rates change. Assign internal ownership (Supply Chain, Finance, or Legal) to monitor for changes and re-assess strategies periodically.

Governance and Risk Management

- Internal Controls: Documented procedures for classification, valuation, and FTA claims. Regular internal audits.

- Customs Recordkeeping: Maintain all supporting documentation (invoices, COOs, manufacturing records) for 5+ years as required by law.

- Partner Diligence: Ensure customs brokers and logistics providers are fully briefed on your optimization strategies and compliance requirements.

Future Trends: Digitalization and Evolving Trade Policy

The landscape of trade and duty optimization is becoming more digital and dynamic.

Technology and Digital Trade

- Blockchain for Provenance: Exploring use for immutable, shared records of origin and supply chain transactions to simplify FTA compliance.

- AI-Powered Classification: Machine learning tools to suggest HS codes and identify potential FTA eligibility based on product descriptions and bills of material.

- Digital Customs Platforms: Increasing global shift to electronic data interchange and single-window systems, making compliance faster but requiring digital readiness.

Geopolitical and Regulatory Shifts

- Friend-Shoring/On-Shoring Incentives: Government policies (e.g., the U.S. CHIPS and Science Act) may create new duty benefits or penalties to encourage regional supply chains.

- Carbon Border Adjustments: Initiatives like the EU’s Carbon Border Adjustment Mechanism (CBAM) will add a new “carbon cost” layer to imports, which must be factored into future landed cost models alongside duties.

- Increasing Scrutiny on Origin: Customs authorities are increasing audits on FTA claims, especially for high-value products like pharmaceuticals. Robust documentation is paramount.

FAQs: Peptide Import Duty Optimization

Q: Our peptide API is manufactured in China, and we import it into the U.S. Are there any FTAs that can reduce the duty?

A: Directly, no. The U.S. has no comprehensive FTA with China. The standard Most Favored Nation (MFN) duty rate (often 3.7-6.5% for peptide APIs) will apply. However, a multi-step optimization strategy exists. First, ensure correct HS classification for the lowest possible MFN rate.

Second, explore if the API qualifies for a special program like the Miscellaneous Trade Bill (MTB) if a suspension is active. Third, and most strategically, consider if a manufacturing step could be moved to a U.S. FTA partner (e.g., Mexico under USMCA, or a CPTPP member like Japan) to transform the API into an “originating” good eligible for 0% duty into the U.S. The cost-benefit of such a supply chain shift requires detailed analysis.

Q: How complex and costly is it to apply for and maintain duty drawback?

A: The complexity and cost are front-loaded. The application process with customs is detailed and requires precise knowledge of drawback laws. Record-keeping is rigorous; you must be able to track imported duty-paid materials through to the exported finished product (or prove substitution). For this reason, many companies outsource drawback filing to specialized third-party experts who work on a contingency fee (a percentage of the recovered duties).

For a peptide manufacturer with significant export volumes, the payoff is substantial—a 99% refund on duties paid on all imported components of the exported product. The key is to perform an analysis to see if the potential refunds justify the administrative cost and complexity.

Q: We use a major logistics provider who handles our customs clearance. Isn’t it their responsibility to find the best duty rate?

A: This is a common and costly misconception. While a good customs broker is an invaluable partner for correctly executing your instructions, the legal responsibility for accurate classification, valuation, and duty payment (termed “reasonable care”) rests solely with the importer of record—your company. The broker acts on your behalf based on the information you provide.

It is your company’s responsibility to have the internal or external expertise to determine the optimal strategy (correct HS code, applicable FTA, use of FTZ) and then instruct the broker accordingly. Relying on the broker to “find the best rate” without your strategic direction is a significant compliance and financial risk.

Core Takeaways

- Duty is Manageable, Not Fixed: Import duties represent a significant, reducible cost in peptide supply chains, offering a direct lever to improve profitability.

- Foundation of Classification & Valuation: All optimization strategies depend on absolutely correct Harmonized System codes and customs values. Errors here invalidate everything else and risk penalties.

- Free Trade Agreements are Key Levers: FTAs can reduce duties to 0%, but require proactive management of Rules of Origin and meticulous documentation (Certificates of Origin).

- Toolbox of Solutions: A comprehensive strategy uses FTAs, duty drawback, foreign-trade zones, and special programs in combination, tailored to the specific product and supply chain.

- Requires a Proactive, Cross-Functional Strategy: Success requires collaboration between Procurement, Supply Chain, Finance, and Legal, supported by technology and ongoing monitoring of the trade landscape.

Conclusion: Integrating Duty Intelligence into Core Business Strategy

In the high-stakes, competitive world of peptide therapeutics, where R&D investments are enormous and pricing pressures intense, leaving money on the table at the border is an unaffordable luxury. Duty optimization through strategic trade agreement utilization is a disciplined, proven approach to securing a sustainable cost advantage. By building internal expertise, leveraging technology, and designing supply chains with trade intelligence in mind, peptide companies can transform a complex regulatory burden into a source of resilience and value. This strategic focus not only protects margins today but also builds the agile, globally intelligent operations required to succeed in the dynamic trade landscape of tomorrow.

Disclaimer

This article contains information, data, and references that have been sourced from various publicly available resources on the internet. The purpose of this article is to provide educational and informational content. All trademarks, registered trademarks, product names, company names, or logos mentioned within this article are the property of their respective owners. The use of these names and logos is for identification purposes only and does not imply any endorsement or affiliation with the original holders of such marks. The author and publisher have made every effort to ensure the accuracy and reliability of the information provided.

However, no warranty or guarantee is given that the information is correct, complete, or up-to-date. The views expressed in this article are those of the author and do not necessarily reflect the views of any third-party sources cited.