The global peptide therapeutics market, on a trajectory to exceed $100 billion, is delivering groundbreaking treatments for conditions ranging from diabetes and obesity to cancer and rare diseases. However, the path from regulatory approval to widespread patient access is fraught with complexity. In today’s value-driven healthcare landscape, a brilliant molecule and regulatory approval are merely table stakes; commercial success is determined by a robust, evidence-based strategy for market access and reimbursement. With payers increasingly demanding proof of superior outcomes and cost-effectiveness, and healthcare systems under relentless budget pressure, peptide developers must integrate commercial planning into R&D from day one.

This definitive guide outlines a proactive, integrated commercial strategy framework, detailing how to build compelling value dossiers, navigate diverse global pricing and reimbursement systems, and execute launch plans that ensure novel peptide therapies reach the patients who need them.

The New Commercial Reality: From Regulatory Approval to Patient Access

Securing market authorization is no longer the finish line; it is the starting gate for the equally challenging race to secure funding and formulary placement.

The Evolving Payer Landscape and Evidence Demands

Payers—national health services, insurance companies, and hospital systems—are now the ultimate gatekeepers:

- Heightened Scrutiny on Cost and Value: Payers demand clear proof that a new therapy offers meaningful clinical or economic advantages over existing standards of care, including generics.

- The Rise of Health Technology Assessment (HTA): Bodies like NICE (UK), ICER (US), and IQWiG (Germany) formally assess the clinical and economic value of new drugs, issuing recommendations that heavily influence reimbursement decisions.

- Budget Impact Analysis (BIA): Even a cost-effective drug can be denied if its introduction would destabilize a payer’s annual budget. Demonstrating manageable budget impact is critical.

- Differentiated Value Propositions: “Me-too” peptides face immense pricing pressure. Success requires clear differentiation in efficacy, safety, convenience, or patient-reported outcomes.

The High Cost of Poor Commercial Planning

Delaying commercial strategy leads to preventable failures:

- Suboptimal Pricing & Market Rejection: Setting a price without understanding payer willingness-to-pay or competitor dynamics leads to formulary exclusion or restrictive coverage.

- Delayed Reimbursement & Lost Revenue: Lengthy, contentious negotiations with payers can delay patient access by 12-24 months post-approval, eroding patent-protected revenue.

- Inability to Demonstrate Value: Clinical trials designed solely for regulatory approval often lack the comparators and endpoints needed to convince payers, creating a post-approval evidence gap.

- Competitive Disadvantage: Competitors with sophisticated market access strategies can outmaneuver a superior product by securing better formulary positioning and stakeholder support.

“The most elegant peptide sequence is commercially irrelevant if it sits on a pharmacy shelf, unreimbursed. Market access is not a sales function; it is a fundamental strategic discipline that must be woven into the very fabric of development. We start building the value dossier the day we select the target indication.” — Dr. Lena Chen, Chief Commercial Officer, Global Access Partners.

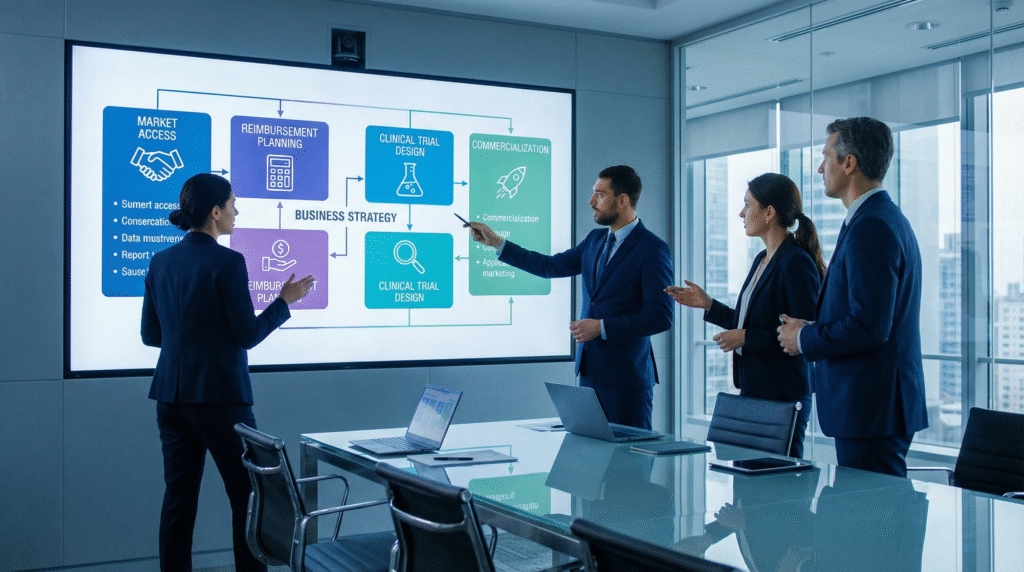

An Integrated Commercial Strategy Framework

Successful market access requires a coordinated, multi-phase approach that begins in early clinical development.

Phase 1: Early Development (Preclinical – Phase II) – Laying the Foundation

This phase is about strategic planning and evidence generation.

| Objective | Key Activities | Outcomes |

|---|---|---|

| Target Product Profile (TPP) & Value Story Development | Define the ideal product profile from clinical, economic, and humanistic perspectives. Articulate a preliminary value story addressing unmet need, differentiation, and potential benefits. | A living TPP document; a draft value story to guide development decisions. |

| Competitive Landscape & Payer Landscape Analysis | Analyze current and future competitors. Map key payer archetypes, decision-makers, and HTA requirements in top target markets (US, EU5, Japan). | Competitive intelligence report; payer landscape map with specific evidence requirements. |

| Clinical Trial Design with Payer Endpoints | Incorporate endpoints valued by payers (e.g., PROs, quality of life, hospitalizations avoided) and relevant active comparators into Phase II/III protocols. | Clinical trial protocols designed for both regulatory and payer audiences. |

| Early Health Economics & Outcomes Research (HEOR) | Develop early cost-effectiveness and budget impact models to identify key value drivers and data gaps. | Preliminary economic models; list of evidence gaps to fill. |

Phase 2: Late-Stage Development (Phase III – Pre-submission) – Building the Dossier

This phase focuses on generating and synthesizing the evidence for submission.

- Finalize Global Value Dossier (GVD): A comprehensive document synthesizing clinical, economic, and humanistic evidence to support the product’s value proposition. This is the core document for payer engagement.

- Conduct Payer & HTA Advisory Boards: Seek formal feedback from payers and HTA bodies on the evolving evidence package and value story. This de-risks future submissions.

- Develop Country-Specific Adaptation Plans: Adapt the global value dossier and economic models to meet the specific requirements and population data of each key market.

- Pricing & Market Access Strategy Finalization: Establish target price ranges, pricing and contracting strategies (e.g., value-based agreements, managed entry agreements), and a core messaging platform.

Phase 3: Launch & Post-Launch (Approval & Beyond) – Execution and Evolution

This phase is about negotiation, execution, and lifecycle management.

- HTA Submissions & Payer Negotiations: Submit dossiers to HTA bodies and enter into direct negotiations with public and private payers to secure reimbursement and formulary placement.

- Launch Excellence: Execute a coordinated launch ensuring field teams are equipped with payer-approved messaging, and that distribution and patient support programs are operational.

- Real-World Evidence (RWE) Generation: Implement studies to confirm the product’s value in real-world clinical practice, providing evidence for price maintenance, label expansion, and negotiations with payers.

- Lifecycle Management: Use additional indications, formulations, or delivery devices to enhance the product’s value proposition and extend its commercial life.

Core Components of a Winning Strategy

Several critical elements must be mastered and integrated.

1. The Global Value Dossier (GVD) and Value Story

The GVD is the cornerstone of all payer communications. It must tell a compelling, evidence-based narrative that answers the payer’s question: “Why should we pay for this?”

- Unmet Need & Burden of Illness: Quantify the clinical, economic, and humanistic burden of the disease.

- Clinical Evidence Summary: Highlight efficacy, safety, and key differentiators versus standard of care.

- Economic Evidence: Present cost-effectiveness and budget impact analyses.

- Patient-Focused Evidence: Include data on quality of life, treatment satisfaction, and convenience.

2. Health Economics and Outcomes Research (HEOR)

HEOR translates clinical data into economic and humanistic value.

| HEOR Component | Purpose | Key Output |

|---|---|---|

| Cost-Effectiveness Analysis (CEA) | Compares costs and health benefits of a new therapy vs. alternatives. Expressed as an Incremental Cost-Effectiveness Ratio (ICER). | ICER vs. willingness-to-pay thresholds (e.g., $50,000/QALY in the US). |

| Budget Impact Analysis (BIA) | Estimates the financial impact of adopting the new therapy on a specific payer’s budget over 3-5 years. | Total budget impact; cost per member per month (PMPM). |

| Comparative Effectiveness Research (CER) | Generates evidence on the effectiveness of treatments in real-world settings. | Real-world data on outcomes, adherence, and resource use. |

3. Pricing Strategy and Innovative Contracting

Pricing must reflect value while ensuring access.

- Value-Based Pricing: Setting the price based on the economic and clinical value delivered, not just on cost of goods or R&D expenditure.

- Differential & International Reference Pricing: Setting different prices in different countries based on ability to pay, while managing cross-border price referencing.

- Managed Entry Agreements (MEAs): Risk-sharing agreements with payers to facilitate access. Types include:

- Outcomes-Based Agreements: Payment is linked to achieving agreed clinical outcomes in specific patients.

- Financial-Based Agreements: Discounts, rebates, or price-volume agreements to manage budget impact.

Peptide-Specific Commercial Considerations

Peptide therapeutics present unique challenges and opportunities for market access.

Challenges

- High Cost of Goods (COGS): Complex synthesis and purification can lead to high production costs, squeezing the margin available for payer discounts and challenging cost-effectiveness.

- Delivery & Administration: Injectable or infusion requirements can be seen as a disadvantage versus oral therapies, impacting patient preference and adding healthcare resource costs.

- Competition with Established Therapies: Entering markets with cheap, generic small molecules or established biologics requires clear superiority.

Opportunities

- High Specificity & Potency: Can translate to superior efficacy and safety profiles, supporting a strong clinical value argument.

- Novel Mechanisms of Action: For diseases with high unmet need, a novel peptide can command a premium price if it delivers transformative outcomes.

- Advances in Delivery: Development of oral, inhaled, or long-acting peptide formulations can significantly enhance the value proposition regarding convenience and adherence.

Future Trends and Strategic Implications

The market access environment continues to evolve, requiring adaptive strategies.

- Increased Focus on Real-World Evidence (RWE): Payers are demanding RWE for coverage decisions. Building RWE generation into the development plan is becoming standard.

- Digital Health Integration: Combining peptide therapies with digital tools (apps, sensors) for monitoring and adherence can create a more compelling, differentiated value package.

- Cell & Gene Therapy Pricing Models as Precedent: The one-time, high-cost models for curative therapies may influence pricing expectations for potentially curative or long-acting peptide therapies.

- Global Harmonization of HTA?: While full harmonization is distant, increased collaboration between HTA bodies (e.g., EUnetHTA) may shape evidence requirements.

FAQs: Peptide Market Access and Reimbursement

Q: How early should we start building our market access strategy for a new peptide therapeutic?

A: The strategy must begin in early preclinical or Phase I development. The key decisions made at this stage—target indication, clinical trial design, choice of comparator, and endpoints—profoundly shape the future value story and evidence package. Waiting until Phase III is too late; you will be constrained by a dataset not designed for payers. Early investment in understanding the competitive landscape, payer needs, and building early economic models is the most effective way to de-risk the commercial pathway and avoid costly post-approval delays.

Q: For a small biotech without a large internal market access team, how can we effectively prepare for launch?

A: Focus on strategic partnerships and selective outsourcing. You can outsource specific functions like HEOR modeling, pricing analytics, and dossier writing to specialized consultancies. However, core strategy ownership must remain in-house. Consider hiring a seasoned Head of Market Access as one of your first commercial hires. Engage with external advisors and payer consultants early for feedback. For the actual launch in a specific country, a partnership with a local distributor or a larger pharma company with an established market access team is often the most effective path for a small biotech.

Q: How important is the cost of goods (COGS) for our peptide API when setting the price and negotiating with payers?

A: While COGS sets the absolute floor for price, it is generally not a primary factor in price negotiations with payers. Payers are focused on the value (clinical benefit, cost-offsets) your therapy provides, not your cost to manufacture. However, a very high COGS can create a strategic challenge: it may limit your ability to offer the deep discounts or rebates often required to secure formulary access in competitive markets, and it can make achieving an acceptable cost-effectiveness ratio more difficult.

Therefore, optimizing manufacturing efficiency and partnering with a reliable, cost-effective API supplier is a critical commercial enabler, not just an operational concern.

Core Takeaways

- Integrated, Early Planning is Non-Negotiable: Market access success depends on integrating commercial strategy into R&D from the earliest stages, not as a post-approval afterthought.

- Evidence is the Currency of Access: A robust, payer-centric evidence package—including clinical, economic, and patient-reported outcomes—is essential to demonstrate value and justify price.

- Master Payer & HTA Requirements: Understanding and proactively addressing the specific evidence needs of Health Technology Assessment bodies and payers in each target market is critical to avoid delays and rejections.

- Value-Based Pricing & Innovative Contracting are Key: Price must reflect demonstrated value, and flexible contracting models (like MEAs) can be powerful tools to overcome payer concerns about cost and uncertainty.

- Execution Requires Cross-Functional Alignment: A successful launch requires seamless coordination between R&D, medical affairs, commercial, and market access teams, all aligned on a common value story.

Conclusion: Securing Patient Access and Commercial Viability

In the high-stakes world of peptide therapeutics, a brilliant scientific breakthrough only fulfills its promise when it reaches patients. A sophisticated, proactive commercial strategy for market access and reimbursement is the essential bridge between regulatory approval and widespread therapeutic impact. By building a compelling, evidence-based value proposition from day one, engaging early with payers, and preparing for complex negotiations, developers can transform their innovative peptides from pipeline assets into accessible, reimbursed, and commercially successful medicines.

The complexity of this journey underscores the importance of every element in the value chain, including the foundation of the therapy itself: a reliable, high-quality, and consistently supplied active pharmaceutical ingredient (API). A robust commercial strategy is built upon a secure and efficient supply chain. Sichuan Pengting Technology Co., Ltd. understands this interconnectedness.

As a professional and reliable peptide API supplier, we contribute to our clients’ commercial success by providing more than just a GMP-compliant ingredient. We offer the supply chain reliability and manufacturing expertise that supports predictable cost of goods—a key input for pricing and economic modeling. Our commitment to quality and consistency helps ensure the clinical and commercial batches are identical, protecting the integrity of the evidence package presented to payers.

By partnering with a strategic API supplier like Sichuan Pengting Technology, peptide developers can solidify the operational foundation of their therapy, allowing them to focus with greater confidence on executing the sophisticated market access strategies that are vital for bringing new hope to patients.

Disclaimer

This article contains information, data, and references that have been sourced from various publicly available resources on the internet. The purpose of this article is to provide educational and informational content. All trademarks, registered trademarks, product names, company names, or logos mentioned within this article are the property of their respective owners. The use of these names and logos is for identification purposes only and does not imply any endorsement or affiliation with the original holders of such marks. The author and publisher have made every effort to ensure the accuracy and reliability of the information provided.

However, no warranty or guarantee is given that the information is correct, complete, or up-to-date. The views expressed in this article are those of the author and do not necessarily reflect the views of any third-party sources cited.