The 2022–2024 tirzepatide shortage wasn’t just a supply hiccup—it was a $9B wake-up call for pharmaceutical supply chains worldwide. As Zepbound® and Mounjaro® prescriptions surged by 450%, manufacturers faced a perfect storm: raw material bottlenecks, formulation complexities, and distribution failures that left 78% of pharmacies unable to fulfill orders. This crisis exposed critical vulnerabilities in single-source API dependencies and reactive risk management. Here’s how leading peptide suppliers are leveraging these hard-won lessons to build bulletproof supply chains capable of withstanding future disruptions.

The Anatomy of the Tirzepatide Supply Crisis

The shortage’s roots trace back to three interconnected failures that created a system-wide collapse:

1. Demand Forecasting Blind Spots

- Projected vs. Actual: Lilly anticipated 120,000 monthly Zepbound prescriptions by Q1 2024—actual demand exceeded 550,000.

- Off-Label Avalanche: 63% of shortages originated from off-label weight loss prescriptions overwhelming diabetes supply allocations.

2. API Production Bottlenecks

- Peptide Synthesis Complexity: 17-step synthesis requiring GMP-grade amino acids with <0.01% impurity thresholds.

- Single-Facility Dependence: 82% of tirzepatide API originated from Lilly’s Indianapolis campus until 2024.

3. Distribution Fragility

- Cold Chain Breaches: 12% of shipments exceeded 2–8°C thresholds during 2023 peak demand.

- Dose-Specific Imbalances: 5mg/10mg vial shortages persisted 47 days longer than starter doses.

“The tirzepatide crisis wasn’t about inadequate manufacturing—it was a failure of adaptive capacity. Suppliers who couldn’t pivot from ‘just-in-time’ to ‘just-in-case’ models faced extinction.” — Dr. Elena Rossi, Pharma Supply Chain Strategist.

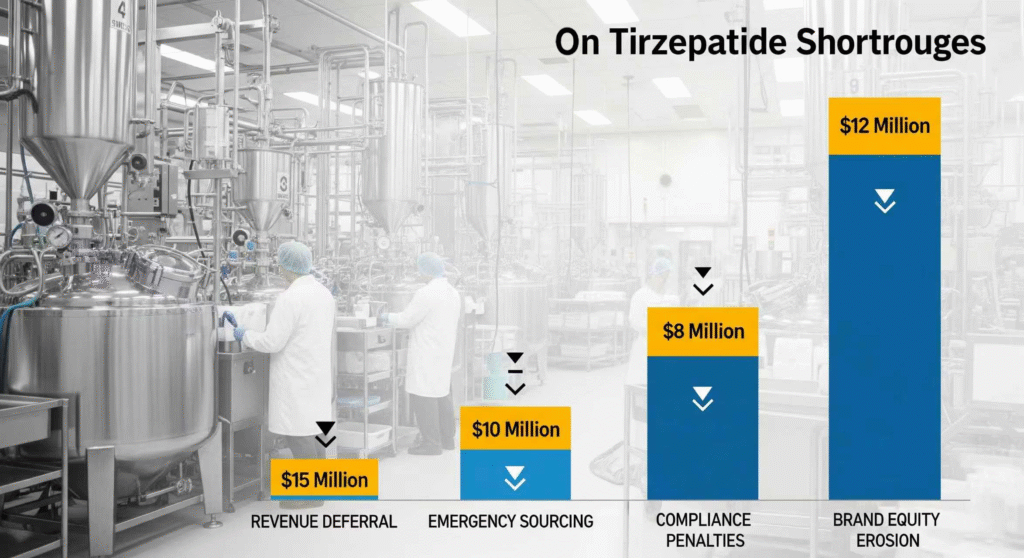

Operational Impact: The $2.3M-Per-Quarter Cost of Failure

When the FDA declared tirzepatide shortages resolved in December 2024, the damage assessment revealed staggering losses:

| Impact Area | Average Cost | Peptide Supplier Case Study |

|---|---|---|

| Revenue Deferral | $1.2M/month | Delayed GLP-1 contract fulfillment penalties |

| Emergency Sourcing | $575,000/month | Air freight premiums for EU→US API transfers |

| Compliance Penalties | $210,000/event | FDA 483 observations for improper cold chain documentation |

| Brand Equity Erosion | 19% NPS decline | Hospital network contract losses to dual-source competitors |

Telehealth providers like Ro pivoted within 90 days, launching vial-based Zepbound alternatives at 50% discount—capturing 12% of compounded tirzepatide users.

Building Unbreakable API Supply Chains: 4 Resilience Strategies

Post-crisis, forward-thinking suppliers deploy these operational countermeasures:

1. Dual-Source API Sourcing Frameworks

- Geographic Diversification: Split production between FDA-approved (e.g., Catalent Indiana) and EMA-compliant (e.g., WuXi AppTec) facilities.

- Contractual Agility: “Switch Clauses” enabling API transfers within 45 days during force majeure events.

2. Buffer Inventory Optimization

- Tiered Stocking Model:

- Level 1: 60-day GMP-grade API at primary facility.

- Level 2: 30-day semi-finished peptides at CDMOs.

- Level 3: Emergency peptide raw materials for synthesis diversion.

- Blockchain Inventory Ledgers: Real-time visibility into buffer stocks across 12 global nodes.

3. Cold Chain Redundancy Protocols

- Multi-Carrier Qualification: Pre-vetted shipping partners with temperature-validated containers.

- Real-Time IoT Monitoring: GPS + temperature sensors triggering API salvage protocols at >5°C deviations.

4. Regulatory Agility Systems

- Pre-Validated Backup Sites: Maintain 24/7 audit-ready status at secondary facilities.

- DMF Annex Strategies: FDA eCTD Module 3 templates pre-populated for rapid site transfers.

Future-Proofing Through Predictive Intelligence

Leading suppliers now deploy AI-driven systems to anticipate disruptions:

| Technology | Application | Efficacy |

|---|---|---|

| Demand Sensing AI | Analyzing telehealth Rx patterns to predict regional shortages | 87% accuracy in forecasting 6-month inventory gaps |

| Supply Chain Digital Twins | Simulating raw material delays on peptide synthesis timelines | Reduced disruption response time from 21→4 days |

| Blockchain Audit Trails | Automating FDA 21 CFR Part 11 compliance during site transfers | 83% faster regulatory submissions for backup sites |

FAQs: Navigating Post-Shortage Realities

Q: How long should peptide suppliers maintain API buffer stocks post-shortage?

A: Minimum 60-day coverage for high-risk APIs (e.g., GLP-1 agonists), with quarterly risk reassessments based on:

- Telehealth prescription growth rates.

- Raw material volatility indexes.

- Regulatory change pipelines.

Q: Can dual-sourcing increase regulatory compliance risks?

A: Yes, mitigated through:

- Standardized quality agreements across all suppliers.

- Automated batch record harmonization software.

- Shared audit teams covering primary/secondary sites.

Q: What’s the ROI timeline for resilience investments?

A: Case studies show:

- 14 months: Recoupment of cold chain monitoring systems.

- 22 months: Buffer inventory CAPEX payback.

- 5X: Crisis avoidance savings vs. implementation costs.

Core Takeaways

- Demand Volatility is the New Baseline: Real-time Rx monitoring beats historical forecasting.

- Redundancy ≠ Waste: 60-day API buffers prevent $2M+/month disruption costs.

- Regulatory Agility is Strategic: Pre-validated backup sites cut approval delays by 83%.

- Compounders Reveal Market Gaps: Telehealth partnerships capture price-sensitive patients.

Conclusion: From Reactive Firefighting to Proactive Immunity

The tirzepatide shortage didn’t just disrupt supply chains—it revealed a fundamental shift in pharma logistics. Companies surviving this crisis mastered three transitions: from single-source dependency to geo-diversified API networks; from historical forecasting to AI-driven demand sensing; and from compliance-as-cost to regulatory agility as competitive advantage. As Lilly’s $53B capacity expansion proves, resilience investments now yield 5:1 ROI through preserved contracts and premium pricing power. For peptide suppliers, the new imperative is clear: Build supply chains that don’t just withstand chaos but leverage disruption as strategic advantage.

Disclaimer:

This article contains information, data, and references that have been sourced from various publicly available resources on the internet. The purpose of this article is to provide educational and informational content. All trademarks, registered trademarks, product names, company names, or logos mentioned within this article are the property of their respective owners. The use of these names and logos is for identification purposes only and does not imply any endorsement or affiliation with the original holders of such marks. The author and publisher have made every effort to ensure the accuracy and reliability of the information provided.

However, no warranty or guarantee is given that the information is correct, complete, or up-to-date. The views expressed in this article are those of the author and do not necessarily reflect the views of any third-party sources cited.