The global peptide therapeutics market, a cornerstone of modern medicine projected to exceed $100 billion, operates on a knife’s edge. While the science behind GLP-1 agonists, antimicrobial peptides, and oncology candidates advances rapidly, the supply chains that deliver these fragile, high-value molecules remain notoriously inefficient. For peptide manufacturers and developers, inventory represents a massive, often poorly optimized capital investment and a significant operational risk—too much inventory ties up cash and risks obsolescence; too little halts clinical trials and commercial supply. In an industry with lead times of 12-24 weeks for custom API and raw material costs measured in thousands per gram, traditional reactive inventory management is a recipe for financial strain and supply vulnerability. This article provides a comprehensive roadmap for peptide inventory optimization, focusing on the strategic deployment of modern demand forecasting models to enable a reliable Just-in-Time (JIT) manufacturing approach, balancing cost, service levels, and resilience in a volatile global landscape.

The Peptide Inventory Conundrum: High Stakes, High Complexity

Managing inventory for peptide active pharmaceutical ingredients (APIs) and intermediates is fundamentally different from managing standard chemical inventory, creating unique challenges and magnifying the cost of error.

Unique Drivers of Peptide Inventory Complexity

- Extraordinarily Long and Variable Lead Times: Custom synthesis, purification, and release of a peptide API can take 3-6 months. Supply of key raw materials (e.g., specialized Fmoc-amino acids) can be equally protracted and unpredictable.

- Prohibitively High Cost of Goods (COGS): Peptide APIs are among the most expensive pharmaceutical ingredients by weight. Holding excess inventory represents millions in tied-up capital and significant carrying costs (storage, insurance, stability testing).

- Clinical Development Volatility: Demand for clinical-stage materials is inherently uncertain. A successful trial result can instantly multiply demand, while a failure can render valuable inventory worthless.

- Limited Shelf Life and Stability Concerns: Peptides can degrade, aggregate, or oxidize. Excess inventory increases the risk of material exceeding its retest date or stability shelf life, requiring costly re-testing or disposal.

- Regulatory and Quality Lock-In: A batch of API is tied to a specific drug master file (DMF) and manufacturing process. It cannot be easily substituted or sold elsewhere, unlike a commodity chemical.

The Business Impact of Poor Inventory Management

The consequences manifest directly on the balance sheet and in operations:

- Excessive Carrying Costs: Capital that could fund R&D is immobilized in warehouse stock.

- Stock-Outs and Clinical/Commercial Delays: A single batch shortage can delay a pivotal trial by months or trigger a drug shortage, incurring massive opportunity costs and regulatory scrutiny.

- Obsolescence and Write-Offs: Failed clinical trials or process changes can lead to the complete write-off of bespoke peptide inventory.

- Inefficient Production Scheduling: Without clear demand signals, manufacturing runs are either too small (increasing per-unit cost) or too large (creating excess).

“In the peptide world, inventory is not an asset; it’s a risk to be managed. Every gram sitting in a freezer represents capital that isn’t advancing science and material that is degrading. The goal of modern inventory optimization isn’t to guess better; it’s to replace guessing with scientific forecasting, transforming the supply chain from a cost center to a strategic accelerator.” — Michael Vance, Chief Supply Chain Officer, Global Biologics Network.

The Foundation: Demand Forecasting Models for Peptide Supply Chains

Accurate demand forecasting is the essential fuel for any inventory optimization engine. The right model depends on the product’s stage and demand pattern.

1. Qualitative Models for Early-Stage and Novel Pipelines

Used when historical data is scarce or non-existent.

| Model | Methodology | Application in Peptide Development |

|---|---|---|

| Delphi Method | Structured communication with a panel of internal and external experts (KOLs, commercial, clinical) to reach a consensus forecast. | Forecasting demand for a first-in-class peptide entering Phase II/III, incorporating clinical success probability and market adoption rates. |

| Sales Force Composite | Aggregating estimates from the commercial or business development team. | Useful for launched products or when forecasting demand for a peptide in a new geographic market. |

| Market Research | Analyzing competitor launches, prescription data analogs, and patient demographic studies. | Building a forecast for a new obesity or diabetes peptide by analyzing the launch trajectory of GLP-1 agonists. |

2. Quantitative Models for Established Products and Raw Materials

Leverage historical data to predict future demand.

| Model | Methodology & Math | Best For |

|---|---|---|

| Time Series Analysis | Analyzes historical demand data to identify trends, seasonality, and cycles.Moving Average: Simple average of past ‘n’ periods.Exponential Smoothing: Weighted average favoring recent data.ARIMA (AutoRegressive Integrated Moving Average): Advanced model for complex patterns. | Forecasting demand for a commercial peptide with 2+ years of sales history, or for stable raw material consumption. |

| Causal/Econometric Models | Identifies cause-and-effect relationships between demand and external variables (leading indicators). Formula: Demand = f(Marketing Spend, Competitor Price, Disease Prevalence, etc.) | Forecasting how a price change or a new competitor launch will impact demand for an established peptide API. |

| Simulation Models | Uses Monte Carlo simulation to model thousands of possible future scenarios based on probability distributions for key inputs (trial success, enrollment rate). | Managing clinical trial material inventory, where demand depends on probabilistic clinical outcomes and patient recruitment rates. |

Integrating Forecasts: The Consensus Demand Plan

Best practice involves synthesizing multiple forecasts:

- Statistical Forecast: Generate a baseline using quantitative models.

- Commercial Overlay: The commercial team adjusts for promotional plans, competitor intelligence, and market shifts.

- Management Consensus: A cross-functional team (Supply Chain, Finance, Commercial, R&D) reviews and agrees on a single, unified “one number” forecast that drives all planning.

Inventory Optimization Strategies: From Safety Stock to JIT Execution

With a reliable forecast, companies can implement sophisticated inventory policies.

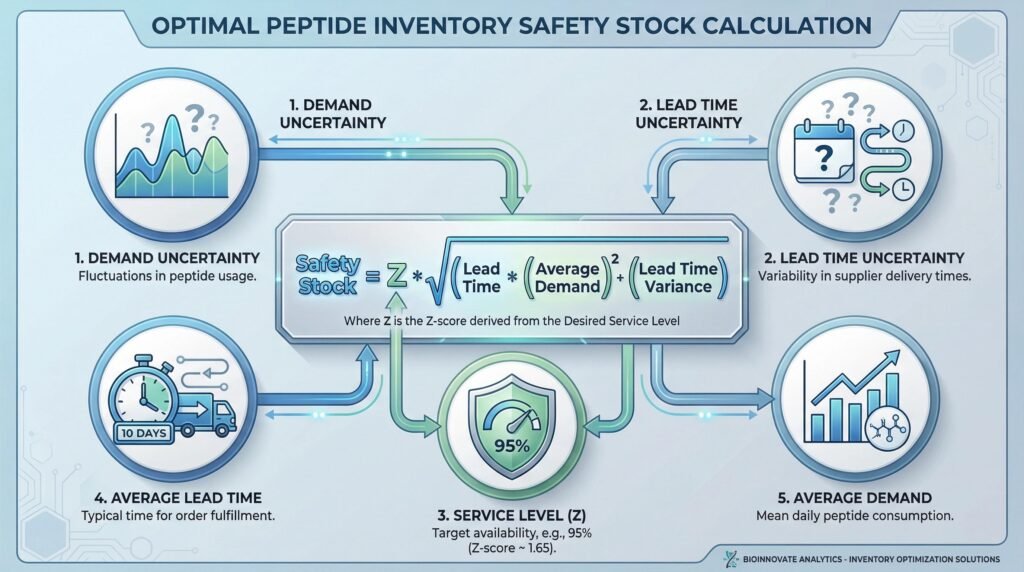

Calculating Optimal Safety Stock

Safety stock buffers against uncertainty in demand and supply. The calculation must account for peptide-specific variables:

- Key Inputs:

- Demand Uncertainty (σD): Standard deviation of forecast error.

- Lead Time Uncertainty (σLT): Variability in supplier lead time.

- Service Level (Z): The desired probability of avoiding a stock-out (e.g., 95% corresponds to a Z-score of ~1.65).

- Average Lead Time (LT) and Average Demand (D).

- Common Formula: Safety Stock = Z * √( (LT * σD²) + (D² * σLT²) )

- Peptide Consideration: The high cost of peptide API often justifies a lower service level (e.g., 90%) for non-critical intermediates, accepting a slightly higher stock-out risk to reduce holding costs.

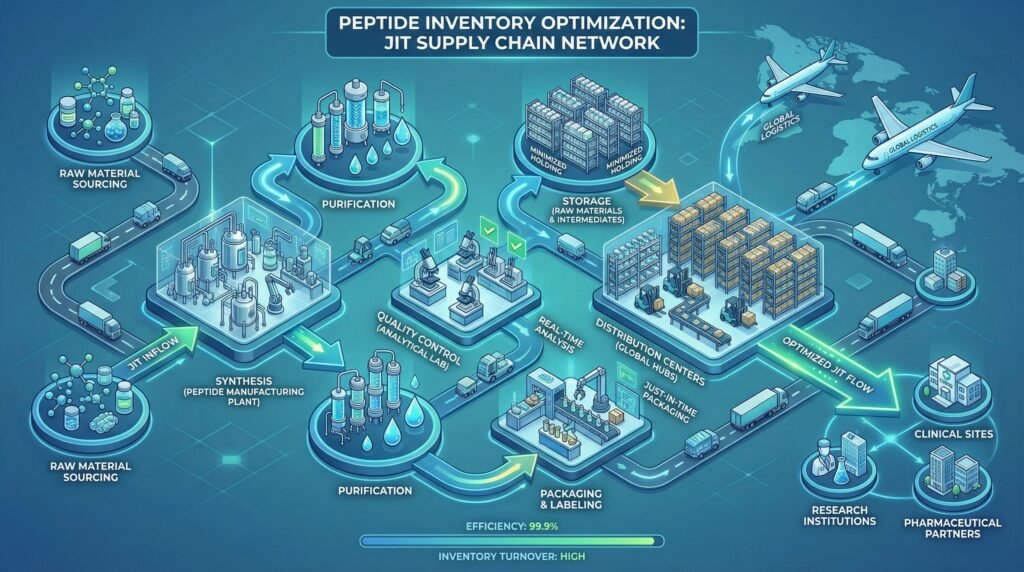

Implementing Just-in-Time (JIT) for Peptides

JIT aims to receive goods only as they are needed in the production process. For peptides, this requires adaptation:

- Prerequisites for Peptide JIT:

- Stable, Reliable Suppliers: Deep partnership with API manufacturers who can commit to shorter, predictable lead times.

- Accurate Demand Signal: The forecasting models discussed above.

- Lean Manufacturing & Setup Reduction: Streamlining changeovers in purification and lyophilization to enable smaller, more frequent batches.

- Robust Quality Agreements: Trust in the supplier’s quality to allow for reduced incoming testing or use of skip-lot testing.

- JIT in Practice:

- VMI (Vendor-Managed Inventory): The supplier (e.g., Sichuan Pengting Technology) monitors the client’s inventory levels and is contractually responsible for maintaining agreed stock levels at the client’s site or a nearby hub.

- Consignment Inventory: The supplier owns the inventory until it is “pulled” for use by the manufacturer. This shifts carrying cost risk to the supplier, requiring a strong partnership.

Multi-Echelon Inventory Optimization (MEIO)

For companies with complex networks (multiple manufacturing sites, distribution centers), MEIO software determines where to hold inventory (API, drug product, finished goods) and in what quantities to minimize total system cost while meeting service level targets.

The Technology Enablers: From Spreadsheets to Digital Twins

Advanced inventory optimization requires moving beyond manual spreadsheets.

- Advanced Planning and Scheduling (APS) Systems: ERP modules or standalone systems (e.g., Kinaxis, o9) that integrate forecasting, inventory planning, and production scheduling in a single environment.

- Demand Sensing: Using real-time data (point-of-sale, prescription data, inventory withdrawals) to adjust forecasts weekly or daily, rather than monthly.

- Digital Twin of the Supply Chain: A dynamic virtual model of the end-to-end peptide supply chain used to simulate disruptions, test different inventory policies, and optimize network design without operational risk.

Building a Resilient Peptide Supply Chain: Beyond Pure Optimization

Optimization must be balanced with resilience, especially post-pandemic.

- Dual Sourcing for Critical Materials: For high-risk peptides or key starting materials, qualifying a second supplier, even at a higher unit cost, is a critical resilience strategy that impacts safety stock calculations.

- Buffer Strategy for Portfolio Management: Holding strategic buffers of platform chemistry raw materials (e.g., common Fmoc-amino acids, resins) that can be used across multiple peptide programs, providing flexibility.

- Scenario Planning: Regularly modeling “what-if” scenarios (supplier fire, raw material price spike, demand surge) to understand the impact on inventory and develop pre-defined response playbooks.

FAQs: Peptide Inventory Optimization and Demand Forecasting

Q: We are a small biotech with one peptide in Phase II. Is investing in advanced forecasting and inventory software overkill for us?

A: Not at all; it’s about right-sizing the approach. You don’t need a million-dollar software suite. Start with a disciplined process using a well-structured spreadsheet. Implement a simple qualitative forecast (Delphi method) with your team, quantifying clinical probabilities. Calculate safety stock for your clinical materials using basic formulas. The key is to institutionalize the habit of forecasting and planning. This discipline will pay off massively as you scale, preventing costly stock-outs or overages. As you progress to Phase III, that’s the time to evaluate more advanced, integrated planning tools.

Q: How do we account for the risk of our clinical trial failing when forecasting demand and planning inventory?

A: This is where probabilistic forecasting and scenario planning are essential. Do not build a single-point forecast. Instead, create multiple demand scenarios:

Scenario 1 (Base Case: Trial Success): Forecast based on anticipated launch trajectory.

Scenario 2 (Trial Failure): Demand falls to zero.

Scenario 3 (Partial Success): Demand for a smaller indication or for further trials.

Assign probabilities to each scenario (e.g., 60% Success, 30% Failure, 10% Partial). Your inventory strategy, especially for commercial-scale API, should be heavily phased, with firm commitments only for early launch volume and options for more. This is a core use case for simulation modeling.

Q: How can our peptide API supplier help us achieve better inventory optimization and move towards JIT?

A: A strategic supplier is a critical enabler. A partner like Sichuan Pengting Technology Co., Ltd. can contribute in several ways: 1) Providing Transparent, Reliable Lead Times: Reducing your lead time uncertainty (σLT), which directly lowers your required safety stock. 2) Offering Flexible Manufacturing Slots: Willingness to produce smaller batches more frequently to match your consumption. 3) Supporting VMI or Consignment Models: Managing the inventory burden and providing visibility. 4) Sharing Market Intelligence: Insights on raw material availability that could impact your supply. A collaborative relationship transforms the supplier from a source of variability to a pillar of your lean inventory strategy.

Core Takeaways

- Forecasting is the Non-Negotiable Foundation: You cannot optimize what you cannot predict. Implement a disciplined, cross-functional demand planning process using models appropriate to your product’s lifecycle stage.

- Safety Stock is a Science, Not a Guess: Calculate safety stock quantitatively using formulas that account for both demand and supply variability, tailored to the high-value, perishable nature of peptides.

- JIT is an Outcome, Not a Tool: Just-in-Time delivery is the result of excellent forecasting, supplier collaboration, and process reliability, not a purchasing tactic. It requires deep partnership with suppliers.

- Technology Scales the Insight: While spreadsheets can start the journey, Advanced Planning Systems and demand sensing tools are necessary to manage the complexity of a global peptide portfolio and achieve true multi-echelon optimization.

- Resilience and Optimization are a Balance: The lowest-cost inventory strategy is often the most fragile. Strategic buffers, dual sourcing, and scenario planning are essential to protect supply in the face of inevitable disruptions.

Conclusion: Transforming Inventory from a Liability to a Strategic Asset

Mastering inventory optimization in the peptide sector is a powerful competitive differentiator that directly enhances financial health, operational agility, and strategic resilience. By moving from reactive, experience-based stocking to a proactive, model-driven approach, companies can unlock significant capital, reduce waste, and ensure that supply becomes a reliable engine for growth rather than a constant source of risk. The integration of sophisticated demand forecasting with tailored inventory policies enables a practical path towards leaner, more responsive operations.

This journey is not undertaken in isolation. Its success is inextricably linked to the capabilities and reliability of the supply base. Sichuan Pengting Technology Co., Ltd. is committed to being the partner that makes this optimization possible. As a professional and reliable peptide API supplier, we provide the manufacturing consistency, transparent communication, and collaborative mindset that reduces supply chain variability—the key to lowering safety stock and enabling JIT flows. Our expertise in scalable synthesis and commitment to on-time delivery provide the stable foundation upon which our clients can build their advanced forecasting and inventory models. By partnering with Sichuan Pengting Technology, peptide innovators can confidently pursue ambitious inventory optimization strategies, secure in the knowledge that their supply chain is built on a foundation of quality and reliability.

Disclaimer

This article contains information, data, and references that have been sourced from various publicly available resources on the internet. The purpose of this article is to provide educational and informational content. All trademarks, registered trademarks, product names, company names, or logos mentioned within this article are the property of their respective owners. The use of these names and logos is for identification purposes only and does not imply any endorsement or affiliation with the original holders of such marks. The author and publisher have made every effort to ensure the accuracy and reliability of the information provided. However, no warranty or guarantee is given that the information is correct, complete, or up-to-date. The views expressed in this article are those of the author and do not necessarily reflect the views of any third-party sources cited.