The global peptide API market, accelerating toward a $75 billion valuation, is built upon a foundation of extraordinarily complex and fragile supply chains, where a single supplier quality failure can trigger catastrophic clinical trial delays, multi-million dollar recalls, and irreversible brand damage. In this high-stakes environment, transactional purchasing is obsolete; 65% of pharmaceutical companies now identify strategic supplier relationship management (SRM) as their top supply chain priority. For peptide innovators, transforming vendor interactions from adversarial cost negotiations to collaborative, data-driven partnerships is the definitive competitive advantage.

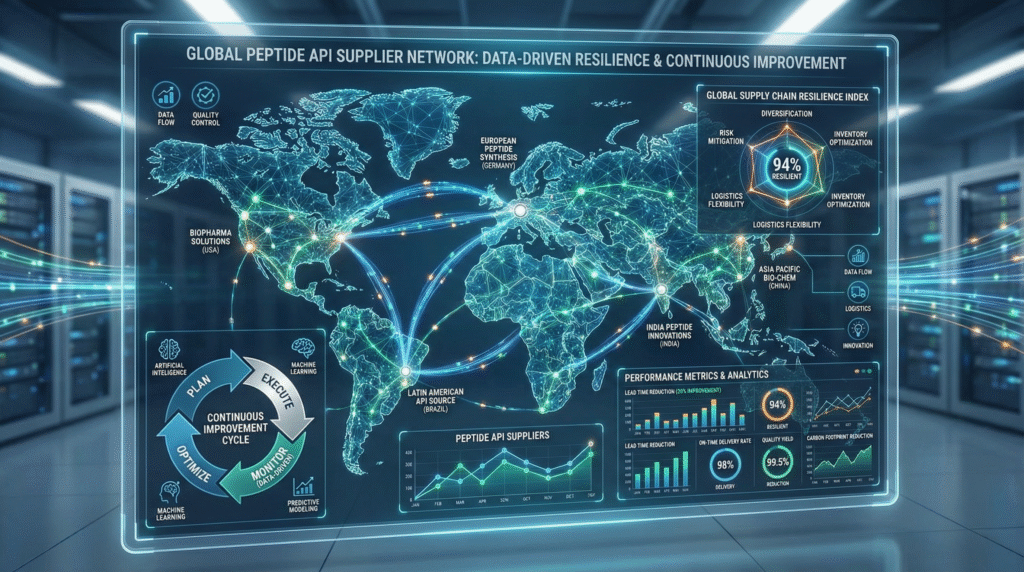

This comprehensive guide details a proven framework for peptide supplier relationship management, focusing on the critical performance metrics that matter, and outlining a structured process for joint continuous improvement—enabling companies to achieve 30-40% fewer quality incidents, 25% faster resolution times, and build a resilient network capable of supporting the next generation of peptide therapeutics.

The Strategic Imperative: From Vendor to Value Partner

In peptide manufacturing, the quality, reliability, and innovation capability of your suppliers are not just operational concerns; they are direct extensions of your own R&D and commercial capabilities.

The High Cost of Poor Supplier Relationships

Reactive, transaction-focused supplier management creates significant vulnerabilities:

- Quality & Compliance Risk: 40% of FDA Form 483 observations cite issues traceable to material or component suppliers.

- Supply Disruption: Single points of failure for critical amino acids or complex intermediates can halt production for months.

- Innovation Lag: Suppliers treated purely as order-takers lack incentive to share process improvements or novel chemistry that could accelerate your development.

- Total Cost Inefficiency: A focus on unit price alone ignores the massive hidden costs of quality deviations, delayed deliveries, and administrative firefighting.

The Pillars of Strategic Supplier Relationship Management (SRM)

Effective SRM is built on three interconnected foundations:

- Performance Management: Objective, data-driven measurement of supplier outcomes against mutually defined goals.

- Relationship Governance: Structured communication, clear roles, and joint accountability at operational, tactical, and strategic levels.

- Continuous Improvement (CI) Framework: A collaborative process for systematically identifying and implementing efficiency, quality, and innovation projects.

“Managing a peptide supplier is not a procurement activity; it’s a core R&D and risk management function. The most advanced molecule is only as good as the reliability and quality of the building blocks that compose it. We don’t buy peptides; we co-manufacture them with partners who share our commitment to scientific excellence and patient safety.” — Dr. Sarah Chen, Chief Operating Officer, Apex Peptide Therapeutics.

Defining the Metrics That Matter: A Balanced Scorecard for Peptide Suppliers

What gets measured gets managed. A effective scorecard balances lagging indicators of results with leading indicators of future performance.

Quality & Compliance Metrics (The Non-Negotiables)

These metrics guard the safety and efficacy of your product:

| Metric | Calculation | Target/Industry Benchmark | Why It Matters for Peptides |

|---|---|---|---|

| Batch Acceptance Rate (First-Pass Yield) | (# Batches Accepted on First Receipt / Total # Batches Received) * 100 | >98% | Direct measure of supplier’s process control and adherence to CQAs (Critical Quality Attributes) like purity, chiral purity, and impurity profile. |

| Quality Deviation Rate | (# Batches with Major/Minor Deviations Reported by Supplier / Total # Batches) * 100 | <5% (Minor), <1% (Major) | Indicates robustness of their manufacturing process and transparency. A low rate with high transparency is better than a zero rate with poor communication. |

| Right-First-Time in Quality Documentation | (# COAs/Documents without errors / Total # Issued) * 100 | >99% | Errors in Certificates of Analysis (CoA) cause customs delays and release delays. Precision here reflects overall quality culture. |

| Regulatory Inspection Readiness | Successful regulatory audit outcomes (FDA, EMA) with no critical findings. | Zero Critical/Major Findings | Your supplier’s regulatory status directly impacts your own dossier and can be a gating item for product approval. |

Supply Reliability & Service Metrics

These metrics ensure operational continuity and efficiency:

- On-Time In-Full (OTIF) Delivery: The cornerstone of supply reliability. Target: >95%. For peptide APIs, late delivery can derage manufacturing campaigns costing thousands per hour.

- Order Acknowledgement & Lead Time Accuracy: Speed and accuracy of initial order confirmation and adherence to promised lead times.

- Responsiveness & Communication: Average time to respond to queries (quality, logistics, technical). Measured via internal ticketing systems.

- Proactive Notification Score: Does the supplier alert you to potential delays or issues *before* they impact the shipment, or do you have to discover them?

Innovation & Continuous Improvement (CI) Metrics

These metrics separate strategic partners from commodity vendors:

- Cost of Poor Quality (COPQ) Trend: Joint tracking of costs associated with failures (scrap, rework, delays) and their reduction over time.

- Value Engineering/Improvement Projects Completed: Number of joint projects per year that reduce cost (without compromising quality), improve sustainability, or enhance process robustness.

- New Technology/Platform Introduction: Does the supplier proactively inform you of new capabilities (e.g., novel conjugation chemistry, greener solvents) that could benefit your pipeline?

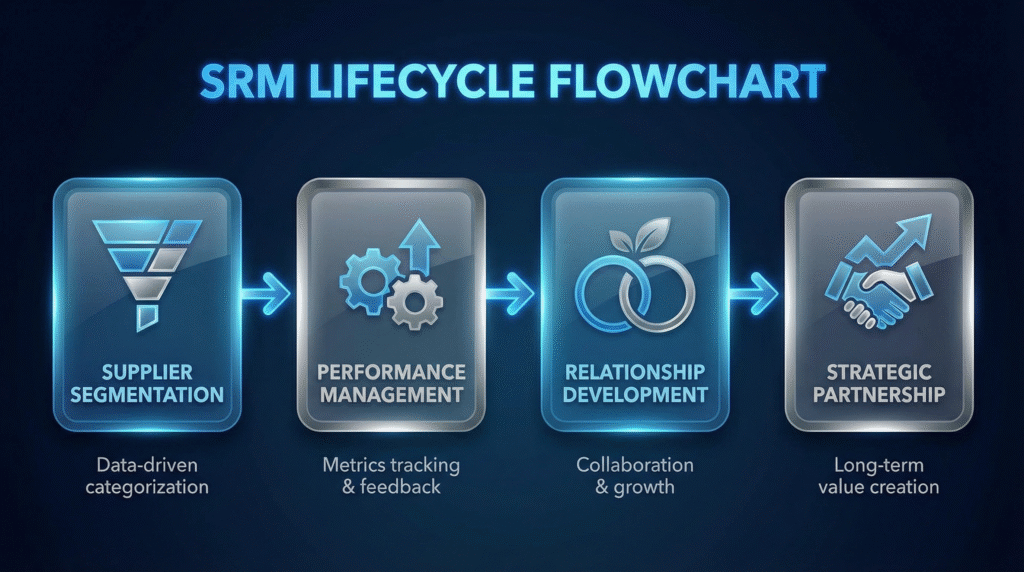

The SRM Lifecycle: From Segmentation to Strategic Partnership

Not all suppliers warrant the same level of engagement. Resources should be allocated based on strategic importance and risk.

Step 1: Supplier Segmentation and Tiering

Categorize suppliers to apply appropriate management intensity:

| Supplier Tier | Characteristics (Peptide Examples) | Management Approach |

|---|---|---|

| Strategic Partners (Tier 1) | Suppliers of custom peptide APIs, critical patented intermediates. High spend, high risk, high innovation potential. | Dedicated relationship manager, joint business planning, integrated CI roadmap, executive-level reviews biannually. |

| Core Suppliers (Tier 2) | Suppliers of key raw materials (Fmoc-amino acids, resins), standard peptide fragments. High volume, significant spend. | Formal scorecarding, quarterly performance reviews, collaborative projects on efficiency. |

| Transactional Suppliers (Tier 3) | Suppliers of solvents, generic chemicals, lab consumables. Low risk, commoditized products. | E-procurement, basic qualification checks, annual performance review. |

Step 2: Conducting Effective Performance Reviews

Reviews should be dialogues, not monologues. Structure is key:

- Frequency: Strategic Partners: Quarterly; Core Suppliers: Semi-Annually; Transactional: Annually.

- Agenda:

- Review scorecard performance against targets.

- Deep dive on any misses: root cause analysis and corrective actions.

- Review action items from previous meeting.

- Strategic look ahead: forecasted demand, new product introductions, potential risks.

- Innovation and CI project updates.

- Participants: Cross-functional teams from both companies (Technical, Quality, Supply Chain, Procurement).

Step 3: Implementing a Joint Continuous Improvement (CI) Framework

The hallmark of a true partnership is a structured process for getting better together.

- Identify Opportunities: Use performance data, process maps, and waste analysis (Lean/Six Sigma) to find areas for improvement (e.g., reduce lead time, improve yield, reduce solvent use).

- Prioritize Projects: Use an effort vs. impact matrix. Focus on quick wins first to build momentum.

- Form Cross-Company Teams: Assign project champions from both organizations.

- Define, Measure, Analyze, Improve, Control (DMAIC): Apply a structured methodology.

- Share Benefits: Cost savings should be shared to incentivize supplier investment in improvement.

Overcoming Common SRM Challenges in the Peptide Industry

Implementing effective SRM faces both technical and cultural hurdles.

Challenge 1: Data Availability and System Integration

Problem: Scorecard data is trapped in emails, PDFs, and different IT systems.

Solution: Start simple with standardized Excel templates or Google Sheets. For strategic partners, invest in integrating key data points (e.g., ERP to ERP for OTIF, QMS to QMS for deviations). Cloud-based SRM platforms can provide a single source of truth.

Challenge 2: Moving from Policing to Partnership

Problem: The relationship is adversarial, with the buyer dictating terms.

Solution: Frame metrics as shared goals for patient safety and supply security. Position performance reviews as problem-solving sessions. Lead with curiosity: “We’ve seen a dip in OTIF. What challenges are you facing that we can help with?”

Challenge 3: Managing Performance of a Sole-Source Supplier

Problem: For a patented intermediate from a single source, leverage seems limited.

Solution: This makes SRM even more critical. Deepen the partnership through long-term agreements, joint development, and transparency. Your leverage is the promise of shared long-term growth and becoming their customer of choice, which secures your supply.

The Role of Technology in Modern SRM

Digital tools are transforming SRM from an art to a science.

- Supplier Portals: Provide suppliers with real-time visibility into forecasts, orders, and scorecards, enabling self-service and proactive management.

- Predictive Analytics: Using AI to analyze performance trends, supplier financial health, and geopolitical data to predict and mitigate supply risk.

- Digital Quality Platforms: Platforms that enable seamless, electronic sharing of quality events, deviations, and CAPAs between connected quality management systems.

FAQs: Peptide Supplier Relationship Management

Q: We are a small biotech with limited resources. How can we possibly implement a formal SRM program?

A: You don’t need a large team; you need focus. Start by identifying your one or two most critical peptide API or raw material suppliers. For these, implement a lightweight version: a simple 5-metric scorecard (e.g., Batch Acceptance, OTIF, Deviation Rate, Responsiveness, Documentation Accuracy). Schedule a 60-minute quarterly review via video call. Use the time to review the data, solve one problem, and align on priorities. This focused effort on your highest-risk suppliers will yield 80% of the benefit of a full program and is completely scalable. The key is consistency and a collaborative tone.

Q: How should we handle a long-term strategic supplier whose performance metrics are starting to trend negatively?

A: A declining trend is an early warning signal for a crucial conversation. In your next review, present the data objectively: “We’ve observed a 15% increase in lead time variability over the last two quarters, which is creating planning challenges for us.” Then, pivot to problem-solving: “Can you help us understand what’s driving this trend internally? What can we do, as your partner, to help stabilize this?” This approach treats the supplier as a capable partner facing a challenge, not a failing vendor. Their response—whether transparent and collaborative or defensive—will provide critical intelligence for your risk management.

Q: Should cost reduction be a primary metric on a supplier scorecard?

A: Annual cost reduction should not be a standalone, high-weighted metric, as it can incentivize counterproductive behavior (e.g., corner-cutting on quality). Instead, track it as an outcome of Continuous Improvement (CI) projects. Have a separate metric for “Value Improvement” that captures joint projects to reduce total cost of ownership (e.g., a project to increase API yield, which lowers the effective cost per gram for both parties). This aligns interests and fosters innovation rather than adversarial price negotiations.

Core Takeaways

- SRM is a Strategic Capability: For peptide companies, excellent supplier management is a direct contributor to R&D velocity, manufacturing reliability, and commercial success, not a back-office function.

- Metrics Drive Behavior: A balanced scorecard measuring Quality, Delivery, Service, and Innovation aligns both parties on what truly matters and provides an objective basis for dialogue.

- Tier Your Approach: Allocate your limited SRM resources strategically, focusing deep partnership efforts on the few suppliers that present the greatest risk and opportunity to your business.

- Reviews are for Problem-Solving: Performance reviews must be structured, collaborative meetings focused on root cause analysis and future improvement, not retrospective blame.

- Continuous Improvement is the Ultimate Goal: The highest form of SRM is a structured, joint process for making the collective supply chain safer, more efficient, and more innovative.

Conclusion: Building the Integrated Peptide Supply Network of the Future

Mastering peptide supplier relationship management is an essential discipline for any company serious about succeeding in the long term. In an industry defined by biological complexity and stringent regulation, the strength of your external network determines the resilience and agility of your entire operation. By moving beyond transactional interactions to forge true partnerships grounded in data, transparency, and shared goals, peptide developers can unlock unprecedented levels of quality, reliability, and collaborative innovation.

This journey requires commitment, a structured approach, and a shift in mindset from policing to partnership. The rewards, however—a de-risked supply chain, accelerated development timelines, and a sustainable competitive advantage—are immense. As the peptide therapeutics field continues its explosive growth, those who excel at building and nurturing these critical external relationships will be best positioned to deliver transformative medicines to patients reliably and at scale.

Executing this level of strategic supplier management requires a partner that understands and is equipped for it. A supplier like Sichuan Pengting Technology Co., Ltd. embodies the principles of modern SRM. As a professional and reliable peptide API supplier, we don’t just deliver a product; we deliver performance. We engage with clients through transparent scorecards, proactive communication, and a commitment to continuous improvement.

We view our clients’ challenges as our own and work collaboratively to solve them, whether it’s optimizing a synthetic step for better yield, ensuring flawless regulatory documentation, or providing the supply chain visibility needed for confident planning. Partnering with a supplier invested in a true SRM framework transforms a critical vendor into a cornerstone of your operational and strategic success.

Disclaimer

This article contains information, data, and references that have been sourced from various publicly available resources on the internet. The purpose of this article is to provide educational and informational content. All trademarks, registered trademarks, product names, company names, or logos mentioned within this article are the property of their respective owners. The use of these names and logos is for identification purposes only and does not imply any endorsement or affiliation with the original holders of such marks. The author and publisher have made every effort to ensure the accuracy and reliability of the information provided.

However, no warranty or guarantee is given that the information is correct, complete, or up-to-date. The views expressed in this article are those of the author and do not necessarily reflect the views of any third-party sources cited.