The global peptide API market, projected to reach $75 billion by 2028, is built on a foundation of fragile supply chains, where a single quality failure at a vendor site can trigger multi-million dollar recalls, clinical trial delays, and irreparable brand damage. In this high-stakes environment, traditional supplier qualification checklists are obsolete, as evidenced by the 30% of pharmaceutical companies reporting a significant quality event linked to a material supplier in the past three years. A paradigm shift to risk-based supplier qualification, powered by integrated quality metrics, is no longer a best practice but a survival imperative.

This methodology enables peptide manufacturers to achieve a 40-60% reduction in quality-related supply disruptions, optimize audit resources by 50%, and build a resilient partner network capable of delivering the consistent, high-quality inputs essential for the next generation of peptide therapeutics.

The Fragile State of Peptide Supply Chains: The Case for a New Approach

Peptide therapeutics present uniquely complex supply chain challenges that demand a more sophisticated, data-driven approach to vendor management.

Inherent Vulnerabilities in Peptide Sourcing

The specialized nature of peptide manufacturing creates concentrated risk:

- Technical Complexity: Multi-step synthesis and purification processes with numerous critical quality attributes (CQAs).

- Limited Supplier Base: High barriers to entry create oligopolies for key building blocks and finished APIs.

- Regulatory Scrutiny: FDA and EMA increasingly inspecting API suppliers, with data integrity and cross-contamination as top citations.

- Long Lead Times: Switching vendors for a peptide intermediate or API can take 12-24 months, creating critical single points of failure.

The Limitations of Binary Qualification

Why traditional “pass/fail” audits are inadequate:

- Static Assessment: A one-time audit provides a snapshot, not a movie, of a supplier’s quality health.

- Resource Intensive: Treating all suppliers with equal scrutiny wastes expert audit resources on low-risk vendors.

- Misses Systemic Trends: Fails to capture performance degradation over time, such as increasing deviation rates or slowing CAPA closure.

- Reactive Posture: Often identifies problems only after they have impacted your supply.

“Selecting a peptide supplier based on price and a static audit is like choosing an airline pilot based on the cost of the ticket and a decades-old license. Risk-based qualification, fueled by real-time quality metrics, allows us to dynamically assess the pilot’s current skill, the plane’s maintenance logs, and the airline’s safety culture before we ever board the flight.” — Michael Vance, VP of Global Supply Chain, Vertex Pharmaceuticals.

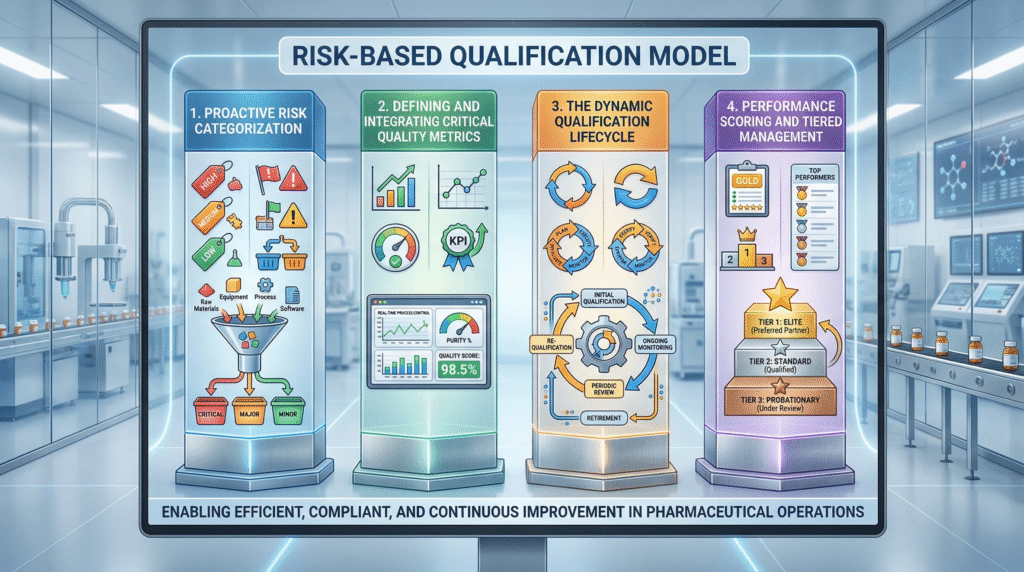

The Framework: A Four-Pillar Risk-Based Qualification Model

An effective system integrates initial risk categorization with ongoing metric-driven surveillance.

Pillar 1: Proactive Risk Categorization of Suppliers

Not all suppliers pose equal risk. A systematic categorization directs appropriate levels of scrutiny:

| Risk Category | Definition | Typical Peptide Examples | Qualification Intensity |

|---|---|---|---|

| High Risk | Suppliers of materials with direct impact on product CQAs, sterility, or safety. | Peptide API, Fmoc-amino acids, critical reagents. | Full on-site audit, extensive quality agreement, continuous metric monitoring. |

| Medium Risk | Suppliers of materials with indirect quality impact or used in early processing stages. | Solvents (DMF, ACN), resins, non-critical excipients. | Desktop audit/questionnaire, routine metric review, periodic on-site audits. |

| Low Risk | Suppliers of materials with negligible quality impact (e.g., utilities, office supplies). | Packaging components (secondary), laboratory consumables. | Basic certification/ questionnaire, ad hoc review. |

Pillar 2: Defining and Integrating Critical Quality Metrics

Moving beyond the Certificate of Analysis (CoA) to a holistic view of quality performance.

Operational Quality Metrics

- Batch Success Rate: Percentage of batches accepted upon first receipt versus those requiring investigation or rejection.

- Deviation & Out-of-Specification (OOS) Rate: Frequency and severity of process deviations and OOS results in the supplier’s own operations.

- Corrective and Preventive Action (CAPA) Effectiveness: Time to close CAPAs and recurrence rate of similar issues.

- Change Control Robustness: Evaluation of the supplier’s management of process, analytical, and site changes.

Supply Reliability & Service Metrics

- On-Time In-Full (OTIF) Delivery: Fundamental metric for supply chain continuity.

- Lead Time Variability: Consistency of promised versus actual lead times.

- Responsiveness & Communication: Timeliness and quality of responses to queries, audit findings, and quality investigations.

Pillar 3: The Dynamic Qualification Lifecycle

Qualification is not a one-time event but a continuous cycle.

- Pre-Qualification Risk Assessment: Categorize supplier risk and define required evidence (audit type, data packages).

- Initial Qualification: Execute audit (onsite/desktop), review quality systems, and establish a Quality Agreement with clear metric reporting expectations.

- Approval & Onboarding: Grant approved status with a defined validity period (e.g., 2-3 years).

- Continuous Monitoring: Regular review of agreed quality and performance metrics (quarterly/annually).

- Periodic Re-Qualification: Re-audit based on risk category, performance trends, and significant changes.

Pillar 4: Performance Scoring and Tiered Management

Quantifying performance to enable data-driven relationship management.

- Supplier Scorecards: Composite score based on weighted metrics (e.g., Quality: 50%, Delivery: 30%, Responsiveness: 20%).

- Tiered Relationship Model:

- Strategic Partners (Top Tier): Collaborate on long-term development, share improvement goals.

- Approved Suppliers (Middle Tier): Maintain business with routine monitoring.

- Under Review (Bottom Tier): Implement performance improvement plans, source alternative suppliers.

Implementation: Building the System and Overcoming Challenges

Translating the framework into action requires addressing technological, organizational, and relational hurdles.

Technology Enablers: From Spreadsheets to Platforms

Tools to manage data and automate oversight:

- Supplier Relationship Management (SRM) Software: Centralized platforms for storing audit reports, quality agreements, and scorecards.

- Quality Management System (QMS) Integration: Linking supplier deviation/OOS data directly from their systems (or via alerts) for real-time monitoring.

- Performance Dashboard: Real-time visualization of key supplier metrics against thresholds.

Common Implementation Pitfalls and Mitigations

| Pitfall | Consequence | Mitigation Strategy |

|---|---|---|

| Metric Overload | Paralysis by analysis; suppliers unable to report consistently. | Start with 5-7 KPIs. Focus on leading indicators of quality health (e.g., deviation trends, CAPA cycle time). |

| Poor Data Quality from Suppliers | Scorecards are inaccurate, leading to bad decisions. | Co-develop metrics and definitions. Start with manual collection, evolve towards system integration. Audit the data. |

| Lack of Cross-Functional Buy-in | Procurement prioritizes cost, while Quality prioritizes compliance, creating conflict. | Establish a cross-functional supplier governance committee. Tie a portion of procurement bonus to quality scorecard results. |

| Treating it as a Police Action | Damages supplier relationships, reduces transparency. | Frame metrics as a tool for shared improvement. Host joint business reviews to solve problems collaboratively. |

The Future of Qualification: Predictive Analytics and Ecosystem Resilience

The next evolution moves from monitoring to prediction and holistic network management.

Predictive Risk Modeling

Leveraging advanced analytics to foresee issues:

- AI-Powered Risk Signals: Analyzing non-traditional data (supplier financial health, geographic risk, employee turnover trends) to predict stability.

- Predictive Quality: Using process data from suppliers to predict potential out-of-spec batches before they are shipped.

From Vendor Selection to Ecosystem Curation

The ultimate goal is building a resilient, transparent network:

- Digital Qualification Passports: Blockchain or secure digital records of a supplier’s audit history and quality credentials, shareable with partners.

- Multi-Tier Visibility: Applying risk-based principles to sub-tier suppliers (e.g., the source of a supplier’s amino acids).

- Resilience Stress Testing: Simulating disruptions (geopolitical, logistical) to understand the true vulnerability of the peptide supply network.

FAQs: Risk-Based Supplier Qualification for Peptide Vendors

Q: How many quality metrics are ideal for a supplier scorecard, and how do we get suppliers to report them consistently?

A: The ideal number is 5-7 key metrics. More than 10 becomes burdensome and dilutes focus. Start with a critical few: On-Time Delivery, Batch Acceptance Rate, Quality Deviation Rate (from the supplier), CAPA Cycle Time, and Audit Compliance. To ensure consistent reporting, co-develop the metrics with key suppliers in a pilot program. Clearly define each metric (numerator/denominator, reporting period) in the Quality Agreement.

Begin with simple, manual quarterly reporting via a standardized template. Recognize and share success stories where metric improvement led to mutual benefit. Over time, this builds the trust and process maturity needed for more frequent or automated data exchange.

Q: For a small biotech with limited resources, how can we implement a risk-based approach without a dedicated supplier quality team?

A: Focus on the Pareto principle: 80% of your supply chain risk comes from 20% of your suppliers. First, identify your 3-5 highest-risk peptide and raw material suppliers. For these, conduct a focused, risk-based desktop assessment using a detailed questionnaire aligned with ICH Q7. Negotiate a robust Quality Agreement that mandates annual summary reports of their key quality metrics (deviation count, batch disposition).

For all other suppliers, use a basic qualification checklist. Leverage third-party audit reports (from organizations like RX-360) where possible. The goal is not perfection, but intelligent allocation of your limited scrutiny to the areas of greatest potential impact on your product and development timeline.

Q: How should we handle a long-tenured, strategic supplier whose performance metrics are beginning to trend negatively?

A: A declining trend is an early warning signal to act proactively, not punitively. Schedule a joint business review at an executive level. Present the data objectively and focus on problem-solving: “We’ve observed a 20% increase in lead time variability over the last three quarters, which is creating planning challenges. What internal changes are you experiencing, and how can we collaborate to stabilize this?” The response will be telling.

A strong partner will be transparent about challenges (e.g., equipment issues, staffing) and co-create a corrective plan. A defensive or dismissive response is itself a major risk indicator. The metrics provide the objective basis for a crucial conversation to either remediate a key relationship or validate the need to begin the lengthy process of finding an alternative.

Core Takeaways

- Shift from Binary to Proportional: Allocate qualification and monitoring effort based on the scientific and supply risk a supplier poses, not a one-size-fits-all checklist.

- Metrics are the Nervous System: Integrated quality and performance metrics transform supplier management from a reactive, anecdotal process to a proactive, data-driven discipline.

- Qualification is a Cycle, Not an Event: Continuous monitoring and periodic re-qualification based on performance are essential to maintain control over a dynamic supply chain.

- Collaboration Over Policing: The most effective use of risk-based qualification is to identify and solve problems with suppliers, building more transparent and resilient partnerships.

- Foundation for the Future: A robust risk-based qualification system is the essential foundation for advanced supply chain strategies like predictive analytics and ecosystem resilience.

Conclusion: Building a Foundation of Trusted Quality for the Future of Peptides

The transition to a risk-based, metrics-driven supplier qualification model represents a fundamental maturation of the peptide industry’s approach to its most critical external partnerships. In a field where product quality is synonymous with patient safety and company viability, trusting but not verifying is an untenable strategy. By systematically assessing risk, integrating meaningful quality signals, and fostering collaborative relationships based on transparent performance, peptide manufacturers can construct supply chains that are not just cost-effective, but predictably reliable and inherently robust.

This disciplined approach does more than prevent failures; it creates a powerful competitive advantage. It enables faster, more confident scaling of manufacturing, provides compelling data for regulatory submissions, and builds the trusted partner network required to navigate an increasingly complex global landscape. The future of peptide therapeutics will be written by those who can master not only the science of molecules, but also the science of securing their flawless and reliable production.

Disclaimer

This article contains information, data, and references that have been sourced from various publicly available resources on the internet. The purpose of this article is to provide educational and informational content. All trademarks, registered trademarks, product names, company names, or logos mentioned within this article are the property of their respective owners. The use of these names and logos is for identification purposes only and does not imply any endorsement or affiliation with the original holders of such marks. The author and publisher have made every effort to ensure the accuracy and reliability of the information provided.

However, no warranty or guarantee is given that the information is correct, complete, or up-to-date. The views expressed in this article are those of the author and do not necessarily reflect the views of any third-party sources cited.