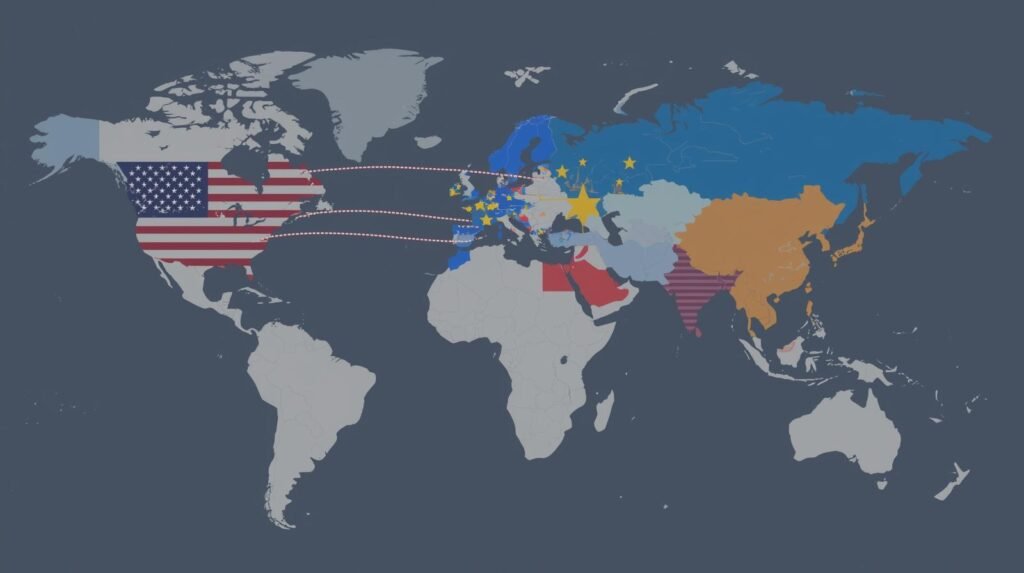

The global peptide supply chain is facing its most significant disruption in decades as escalating tariff wars between major economic blocs threaten to reshape sourcing strategies forever. With the US imposing 25-50% tariffs on Chinese imports and the EU implementing retaliatory measures, peptide manufacturers and pharmaceutical companies are facing cost increases that could reach $4.8 million annually for a single mid-sized CDMO. This comprehensive guide reveals how dual sourcing strategies are emerging as the definitive solution for maintaining peptide supply chain resilience while navigating the complex landscape of international trade tensions. Learn how forward-thinking companies are leveraging geographic diversification, strategic partnerships, and innovative logistics to turn tariff challenges into competitive advantages.

The Tariff Landscape: Understanding the New Reality

The current trade environment presents unprecedented challenges for peptide suppliers and manufacturers. The US-China trade war has imposed 25% tariffs on synthetic peptides under HS code 293499, while additional tariffs on pharmaceutical intermediates continue to escalate. Meanwhile, the EU has implemented retaliatory measures that create a complex web of compliance requirements for international shipments.

These tariffs aren’t uniform across all regions, creating both challenges and opportunities. Under USMCA, North American trade partners enjoy certain exemptions, while ASEAN-EU free trade agreements provide preferential treatment for products manufactured in member countries. This fragmented landscape means strategic sourcing decisions can dramatically impact total landed costs.

| Region | Base Tariff Rate | Peptide-Specific Surcharges | Key Considerations |

|---|---|---|---|

| United States | 10% (most partners) | 25% on Chinese peptides | USMCA exemptions available |

| European Union | Varies by country | Retaliatory tariffs on US goods | REACH compliance required |

| China | Response tariffs | 145% blanket rate from US | Local sourcing advantages |

“The Canadian patent lapse wasn’t an oversight—it was a calculated exit from a market where CSP protection was untenable. Generic buyers must replicate this strategic calculus when prioritizing sourcing corridors.” — Steven Shape, Intellectual Property Chair, Omnus Law.

Why Dual Sourcing? The Strategic Imperative

Dual sourcing has evolved from a risk mitigation tactic to a core business strategy for peptide companies operating in the current tariff environment. The approach involves maintaining relationships with multiple suppliers for the same component or material, typically in different geographic regions.

The Multi-Faceted Benefits of Dual Sourcing

- Risk Mitigation: Reduces dependency on single suppliers vulnerable to geopolitical tensions, natural disasters, or regulatory changes.

- Enhanced Negotiating Power: Multiple suppliers create competition, leading to better terms, pricing, and service levels.

- Supply Chain Resilience: Ensures continuity of operations even when one supplier faces disruptions.

- Tariff Optimization: Allows companies to route products through lowest-tariff corridors based on current trade policies.

Implementing Dual Sourcing: A Practical Framework

Successful dual sourcing implementation requires careful planning and execution across multiple dimensions of supply chain management.

Supplier Selection and Qualification

Identifying and qualifying the right partners is the foundation of an effective dual sourcing strategy. Key considerations include:

- Geographic Diversity: Choose suppliers in different tariff zones to maximize flexibility.

- Quality Consistency: Ensure both suppliers meet identical quality standards through rigorous auditing.

- Capacity Alignment

- Regulatory Compliance: Ensure partners maintain necessary certifications (GMP, ISO, etc.) for target markets.

Logistics and Supply Chain Configuration

Optimizing logistics is critical for dual sourcing success. Effective approaches include:

- Regional Hub Strategy: Establish distribution centers in low-tariff regions to minimize final-mile duties.

- Bonded Warehouses: Utilize facilities that allow duty deferral until products enter the market.

- Inventory Buffering: Maintain strategic stock levels to bridge supply gaps during tariff-related disruptions.

Regional Analysis: Sourcing Opportunities and Challenges

Different regions offer distinct advantages and challenges for peptide sourcing in the current tariff environment.

China: Maintaining Access Despite Tariffs

Despite tariff challenges, China remains a critical player in peptide production, accounting for over 60% of global output. Chinese manufacturers have responded to tariffs through several adaptive strategies:

- Localized Sourcing: Reducing reliance on imported raw materials to minimize tariff exposure.

- Process Innovation: Investing in automation and efficiency improvements to offset tariff costs.

- Product Upgrading: Shifting to higher-value peptides where tariff impacts are less pronounced.

Southeast Asia: The Emerging Alternative

Countries like Thailand and Vietnam are becoming increasingly attractive for peptide sourcing due to:

- Preferential Trade Agreements: ASEAN-EU FTA provides tariff advantages for European-bound peptides.

- Lower Production Costs: Operational expenses 20% below Mexican alternatives.

- Growing Expertise: Rapid development of technical capabilities and regulatory compliance.

European Options: Quality at a Premium

EU-based peptide production offers advantages despite higher costs:

- Regulatory Alignment: Built-in compliance with strict EU standards.

- Tariff Avoidance: No import duties for EU-bound products.

- Sustainability Credentials: Strong environmental standards appealing to ESG-conscious buyers.

Cost-Benefit Analysis: Dual Sourcing Economics

Implementing dual sourcing requires investment but delivers significant long-term returns through risk mitigation and cost optimization.

| Cost Component | Single Sourcing | Dual Sourcing | Net Impact |

|---|---|---|---|

| Supplier Qualification | $50K-100K | $100K-200K | +$50K-100K |

| Tariff Exposure | 25-50% of product value | 0-25% (optimizable) | 25%+ reduction |

| Supply Disruption Costs | High risk | Low risk | Major savings potential |

| Negotiation Leverage | Limited | Significant | 5-15% cost reduction |

Implementation Roadmap: Building Your Dual Sourcing Capability

Transitioning to a dual sourcing model requires a structured approach across multiple business functions.

Phase 1: Assessment and Planning (Weeks 1-4)

- Conduct tariff impact analysis on current supply chain.

- Identify critical components best suited for dual sourcing.

- Develop supplier evaluation criteria.

- Establish implementation budget and timeline.

Phase 2: Supplier Identification and Qualification (Weeks 5-12)

- Identify potential secondary suppliers.

- Conduct on-site audits and quality assessments.

- Negotiate terms and establish contracts.

- Develop joint contingency plans.

Phase 3: Operational Integration (Weeks 13-24)

- Implement quality alignment protocols.

- Establish dual inventory management systems.

- Train procurement team on new processes.

- Develop performance monitoring metrics.

Phase 4: Optimization and Scaling (Ongoing)

- Continuously monitor supplier performance.

- Expand dual sourcing to additional components.

- Refine logistics and inventory strategies.

- Leverage increased negotiating power.

Future Outlook: The Long-Term Perspective

The tariff environment is likely to remain volatile, making dual sourcing not just a temporary fix but a permanent feature of resilient peptide supply chains. Companies that implement these strategies effectively will gain significant competitive advantages through:

- Enhanced Regulatory Compliance: Ability to adapt to changing trade policies across multiple jurisdictions.

- Cost Stability: Reduced exposure to tariff fluctuations and supply chain disruptions.

- Market Flexibility: Capacity to serve diverse markets with varying requirements.

- Competitive Positioning: Stronger negotiation position and customer value proposition.

FAQs: Dual Sourcing for Peptide Supply Chains

Q: How much does it typically cost to implement a dual sourcing strategy?

A: Implementation costs vary based on complexity but typically range from $200,000 to $500,000 for a mid-sized peptide company. This includes supplier qualification, quality alignment, process changes, and initial inventory buildup. The investment typically pays for itself within 12-18 months through tariff avoidance and improved negotiation leverage.

Q: Can small companies implement effective dual sourcing strategies?

A: Yes, though they may need to approach it differently. Smaller companies can focus on dual sourcing for their most critical or tariff-vulnerable components first, rather than attempting a full-scale implementation. Partnering with sourcing agents or joining buying consortiums can also provide economies of scale.

Q: How do we maintain quality consistency between multiple suppliers?

A: Implement rigorous quality alignment protocols including:

- Standardized specifications and testing methods.

- Regular comparative testing and inter-lab validation.

- Joint quality improvement initiatives.

- Shared quality metrics and reporting.

Q: What’s the biggest mistake companies make when implementing dual sourcing?

A: The most common mistake is treating dual sourcing purely as a cost reduction exercise rather than a risk mitigation strategy. Companies that aggressively pit suppliers against each other for minimal price advantages often sacrifice quality, innovation, and long-term relationship benefits that are more valuable than minor cost differences.

Core Takeaways

- Dual sourcing is essential, not optional: Tariff volatility makes single sourcing increasingly risky for peptide supply chains.

- Strategic implementation pays dividends: Properly executed dual sourcing reduces costs, mitigates risks, and enhances negotiating power.

- Geographic diversity matters: Spreading suppliers across different tariff regions provides maximum flexibility.

- Quality alignment is critical: Consistent quality across suppliers requires intentional effort and investment.

- The approach must be holistic: Successful dual sourcing integrates procurement, logistics, quality control, and supplier management.

Conclusion: Building Tariff-Resilient Supply Chains

The peptide industry stands at a crossroads where traditional sourcing approaches are no longer sufficient in an era of escalating trade tensions and regulatory complexity. Dual sourcing has emerged as the most effective strategy for navigating this challenging landscape, offering both protection against tariff disruptions and opportunities for enhanced competitive positioning.

Companies that embrace this approach strategically—investing in supplier relationships, building geographic diversity, and aligning quality systems—will not only survive the current tariff wars but emerge stronger and more resilient. The future belongs to organizations that can flexibly navigate complex international trade environments while maintaining reliable, cost-effective access to critical peptide inputs.

As trade policies continue to evolve, the principles of dual sourcing provide a stable foundation for building supply chains that can withstand whatever challenges emerge next. The time to implement these strategies is now, before the next wave of disruptions hits.

Disclaimer:

This article contains information, data, and references that have been sourced from various publicly available resources on the internet. The purpose of this article is to provide educational and informational content. All trademarks, registered trademarks, product names, company names, or logos mentioned within this article are the property of their respective owners.

The use of these names and logos is for identification purposes only and does not imply any endorsement or affiliation with the original holders of such marks. The author and publisher have made every effort to ensure the accuracy and reliability of the information provided. However, no warranty or guarantee is given that the information is correct, complete, or up-to-date. The views expressed in this article are those of the author and do not necessarily reflect the views of any third-party sources cited.