The global peptide therapeutic landscape is a frontier of immense promise and equally immense regulatory complexity. With over 150 peptide drugs in clinical development and the market accelerating toward $100 billion, the pace of scientific innovation is met by an equally dynamic and often fragmented global regulatory environment. A change in an ICH guideline, a new pharmacopoeial monograph, or an updated enforcement policy from a single health authority can necessitate costly reformulations, re-analyses, or clinical study redesigns. In this context, passive compliance is a recipe for delay and obsolescence. Proactive Regulatory Intelligence (RI)—the systematic identification, analysis, and strategic application of information about current and future regulatory requirements—has become the critical differentiator.

This article provides a comprehensive framework for building and operating a robust peptide-focused RI function, enabling organizations to not just react to changes, but to anticipate them, ensuring continuous global compliance, accelerating development timelines, and safeguarding market access.

The High Cost of Regulatory Blindness in a Dynamic Peptide Landscape

For peptide developers and manufacturers, operating without a structured intelligence function is akin to navigating a storm without radar.

The Velocity and Impact of Regulatory Change

The regulatory baseline for peptides is constantly shifting across multiple dimensions:

- Guideline Evolution: Core ICH guidelines (Q3, Q6, Q11) are periodically revised, impacting impurity control, specifications, and development approaches for both synthetic and recombinant peptides.

- Regional Policy Shifts: Agencies like the FDA (via PDUFA commitments) and EMA issue new guidance on specific topics—CMC for peptide products, nitrosamine risk assessment, continuous manufacturing—that may not be formally harmonized globally.

- Pharmacopoeial Updates: The USP, Ph. Eur., and JP regularly update general chapters and specific monographs affecting analytical methods, acceptance criteria, and raw material standards.

- Emerging Market Requirements: Countries like China (NMPA), India, and Brazil are rapidly evolving their regulatory frameworks, creating new and sometimes unique expectations for data and submissions.

Consequences of Inadequate Intelligence

Failure to track and implement changes leads to direct business harm:

- Clinical Holds and Major Objections: Submitting a dossier based on outdated guidelines results in questions, delays, and potentially Complete Response Letters (CRLs) or refusal of a Marketing Authorisation Application (MAA).

- Costly Remediation: Retrofitting a process or analytical method to meet a new requirement discovered late in development is exponentially more expensive than designing for it from the start.

- Supply Chain Disruption: A new raw material testing requirement or a change in a starting material expectation can halt API production if not anticipated and planned for.

- Competitive Disadvantage: Competitors with superior RI can design more efficient, globally-aligned development programs, reaching the market faster and with fewer regulatory hurdles.

“Regulatory intelligence is not about collecting documents; it’s about translating the faint signals of future requirements into actionable today. For a peptide company, the most valuable asset isn’t just the molecule in the vial, but the forward-looking insight that ensures that vial can be manufactured, submitted, and approved in every market, under the rules that will be in effect tomorrow.” — Dr. Anya Sharma, Head of Global Regulatory Policy, BioPept Innovations.

Defining the Scope: What Constitutes Peptide Regulatory Intelligence?

Effective RI is targeted. It focuses on information that directly impacts the peptide product lifecycle.

Core Components of a Peptide-Focused RI System

| Intelligence Category | Key Sources & Examples | Impact Area |

|---|---|---|

| Strategic & Policy Intelligence | FDA/EMA public meetings, strategic plans, PDUFA/EMA work plans, ICH meeting reports, health authority commissioner speeches. | Long-term R&D strategy, target product profile design, choice of expedited pathways. |

| Guideline & Regulation Intelligence | New draft/final guidelines (ICH, FDA, EMA), updated regulations (e.g., EU CTR 536/2014), pharmacopoeia revisions (USP-NF updates). | Clinical trial design, CMC strategy, analytical method development, quality system procedures. |

| Competitive & Product Intelligence | Competitor approval documents (EPARs, FDA labels), Advisory Committee meeting minutes, competitor patent filings. | Clinical endpoints, regulatory argumentation, CMC control strategies, lifecycle management. |

| Enforcement & Inspection Intelligence | FDA Warning Letters, EMA GMP Non-Compliance Reports, inspection trends from industry conferences. | GMP operations, quality system focus areas, audit preparedness, risk mitigation. |

| Horizon Scanning & Emerging Trend Intelligence | Scientific conferences, peer-reviewed literature on novel modalities (e.g., cell-penetrating peptides, oral delivery), regulatory science research papers from agencies. | Early R&D investment, platform technology evaluation, engagement in regulatory sandbox programs. |

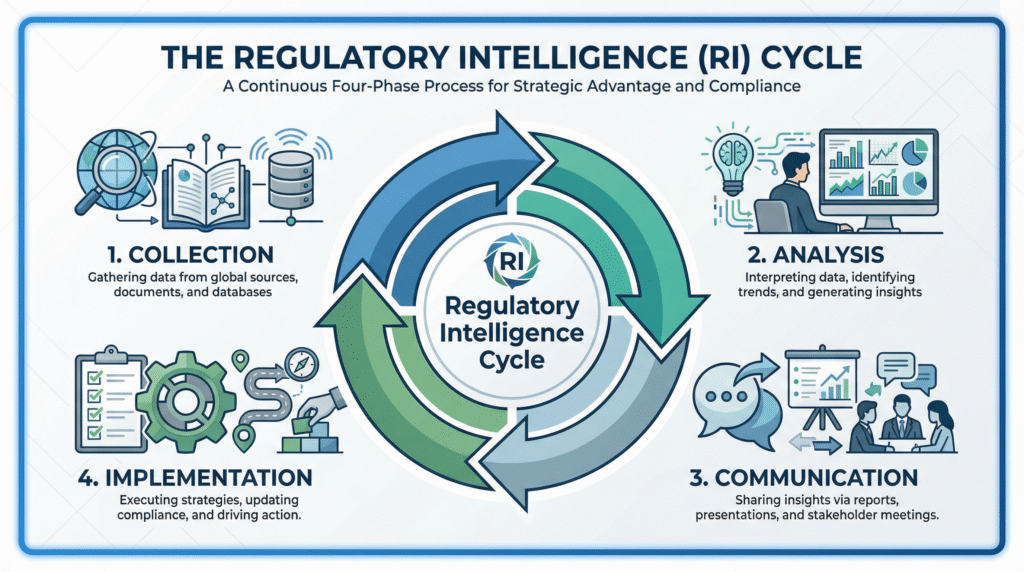

The Regulatory Intelligence Cycle: From Collection to Action

A sustainable RI function operates as a continuous, four-phase cycle, not a one-off project.

Phase 1: Systematic Collection and Monitoring

Deploying the right tools and sources to capture relevant information.

- Primary Sources (Non-Negotiable):

- Agency Websites & Alerts: FDA, EMA, PMDA, NMPA, and other target health authority websites. Subscribe to RSS feeds and email alerts.

- Pharmacopoeia Services: USP PF Online, Ph. Eur. EDQM subscription for early access to proposed changes.

- ICH & International Bodies: Monitor ICH, WHO, and PIC/S websites for harmonization activities.

- Secondary & Curated Sources:

- Commercial Intelligence Databases: Services like Cortellis, Reuters Pharma, RAPS provide filtered, analyzed regulatory news.

- Professional Associations: RAPS, PDA, DIA conferences and publications offer distilled insights and networking.

- Specialized Consultants & Legal Firms: Provide deep, interpreted analysis of complex regional changes.

- Technology Enablers: Use AI-powered monitoring tools that can scan, categorize, and summarize regulatory documents based on predefined keywords (e.g., “peptide,” “impurity,” “starting material”).

Phase 2: Analysis, Triage, and Impact Assessment

Transforming raw data into actionable insight.

- Categorization: Tag the information by type (guideline, enforcement), geography, and relevant product lifecycle stage (discovery, clinical, commercial).

- Criticality Assessment: Rate the potential impact (High/Medium/Low) and urgency (Immediate/Short-term/Long-term) on your portfolio.

- Gap Analysis: For a significant change, conduct a formal gap analysis: “What is the new requirement?” vs. “What is our current practice?” This identifies specific actions needed.

- Stakeholder Summary: Produce a concise, non-technical summary for leadership and a detailed technical assessment for CMC, Clinical, and Quality teams.

Phase 3: Strategic Communication and Implementation Planning

Driving the organization to act on the intelligence.

- Cross-Functional RI Review Meetings: Regular (e.g., quarterly) meetings with representatives from Regulatory, CMC, Clinical, Quality, and R&D to discuss high-priority intelligence and agree on action plans.

- Actionable Alerts and Playbooks: Distribute targeted alerts, not data dumps. For recurring changes (e.g., a pharmacopoeia update), create a standard operating procedure (SOP) or “playbook” for implementation.

- Integration with Change Control: Significant required changes must flow into the formal Pharmaceutical Quality System (PQS) change control process to ensure documented, validated implementation.

Phase 4: Implementation, Verification, and Feedback

Closing the loop to ensure changes are effective and to refine the intelligence process.

- Project Management: Assign owners and timelines for each action item arising from the gap analysis (e.g., “Update Method XYZ per USP <621> by Q3”).

- Verification: Confirm that changes have been successfully implemented in processes, specifications, and submissions.

- Feedback for Continuous Improvement: Gather input from implementation teams on the clarity and usefulness of the intelligence provided to refine future collection and analysis.

Building the RI Function: Resourcing and Organizational Models

The scale of the RI function should match the company’s size and global ambition.

| Organizational Model | Description | Best For |

|---|---|---|

| Centralized Dedicated Team | A core RI group that serves the entire organization, providing standardized reports and analysis. | Large pharma, established biotech with broad global portfolios. |

| Embedded/Functional Model | RI responsibilities are distributed among regulatory affairs staff assigned to specific projects or regions. | Mid-sized biotechs with focused portfolios; requires strong coordination. |

| Hybrid Model | A small central RI function sets strategy and tools, while embedded regulatory staff perform day-to-day monitoring for their assets. | Most scalable model for growing companies. |

| Outsourced/Co-sourced Model | Leveraging external consultants or specialized RI service providers for monitoring and analysis, with internal oversight. | Small companies/virtual biotechs, or to supplement internal capacity for specific regions. |

The Future of Regulatory Intelligence: AI, Predictive Analytics, and Collaboration

The field is moving from reactive monitoring to predictive and prescriptive analytics.

- AI and Natural Language Processing (NLP): Advanced tools will not just find documents but predict the probability of a draft guideline being finalized, summarize public consultation comments, and suggest potential impacts on a company’s specific pipeline.

- Predictive Analytics for Inspection Readiness: Analyzing trends in GMP warning letters to predict which areas might be the focus of future inspections, allowing for preemptive remediation.

- Regulatory Network Analysis: Mapping the relationships between different guidelines and precedents to understand the cascading impact of a single change.

- Pre-Competitive Collaboration: Industry consortia (e.g., through BIO or PhRMA) pooling resources to analyze complex regulatory science questions and advocate for sensible, science-based policies.

FAQs: Peptide Regulatory Intelligence

Q: As a small peptide-focused biotech, we can’t afford a dedicated RI team or expensive databases. What is the minimum viable RI process we should implement?

A: Start with a focused, manual process. Designate one person (e.g., the lead regulatory affairs professional) to spend 2-3 hours per week on systematic monitoring. Set up free email alerts from the FDA, EMA, and ICH websites. Follow key regulatory officials on professional social media (LinkedIn). Subscribe to the free USP Pharmacopeial Forum.

Prioritize intelligence related to your specific peptide modality (e.g., synthetic vs. recombinant) and your lead indication. Hold a monthly 30-minute internal meeting with your CMC and clinical leads to review findings. This lean approach catches the majority of critical changes and builds the business case for more resources as you grow.

Q: How do we distinguish between a “nice-to-know” regulatory update and a “must-act” critical change?

A: Use a consistent impact-urgency matrix. A change is “must-act” if it is both High Impact (directly affects your product’s CQAs, clinical study design, or control strategy) and High Urgency (effective date is imminent, or a submission is pending). For example, a new FDA guidance on controlling a specific mutagenic impurity in peptide synthesis is High Impact/High Urgency if your API uses a relevant reagent. An update to a general chapter on dissolution testing for tablets is likely Low Impact for an injectable peptide. Documenting your assessment rationale is key.

Q: How can our API manufacturer support our regulatory intelligence efforts?

A: A proactive API supplier is an extension of your intelligence network. A strong partner like Sichuan Pengting Technology Co., Ltd. will have its own active RI function monitoring changes that affect raw materials, synthesis, and GMP. They should proactively communicate relevant changes (e.g., new Ph. Eur. monographs for amino acids, updated solvent residue limits) and their planned implementation strategy. They can provide critical intelligence on regional expectations (e.g., specific CMC data expected by NMPA) based on their submission experience.

Your Quality Agreement should outline expectations for notification of regulatory changes that affect the supplied material. Choosing a supplier that views compliance as a shared, forward-looking mission dramatically de-risks your supply chain.

Core Takeaways

- Regulatory Intelligence is a Strategic Capability, Not a Support Function: Proactive RI is essential for de-risking development, avoiding costly delays, and maintaining global compliance in the fast-evolving peptide sector.

- Structured Process is Key: Effective RI requires a disciplined cycle: systematic collection, rigorous analysis, strategic communication, and verified implementation, integrated into the quality system.

- Focus on Actionable Insight: The goal is not to amass data, but to produce analyzed intelligence that drives specific business and development decisions, supported by clear impact assessments and gap analyses.

- Leverage Technology and Partnerships: AI tools and curated services can enhance efficiency. Strategic partnerships with API suppliers and CROs extend your intelligence-gathering network.

- Invest According to Portfolio Criticality: The scale of the RI function can be scaled from a lean, focused model for small biotechs to a centralized, technology-enabled team for large enterprises, but the core process principles remain the same.

Conclusion: Mastering the Regulatory Tide for Sustainable Peptide Innovation

In the complex and globalized world of peptide therapeutics, regulatory change is the only constant. Organizations that treat compliance as a static destination will find themselves perpetually behind, remediating issues at great cost. Those that embrace regulatory intelligence as a core strategic discipline transform compliance from a reactive burden into a proactive competitive advantage. By systematically tracking the horizon, deeply analyzing the implications, and seamlessly implementing required changes, companies can ensure their innovative peptides are developed and manufactured under the most current and scientifically rigorous standards, paving the smoothest and fastest path to patients worldwide.

This journey requires expertise that permeates the entire value chain. It underscores the importance of selecting partners whose commitment to quality is undergirded by a robust understanding of the regulatory landscape. Sichuan Pengting Technology Co., Ltd. embodies this partnership ethos. As a professional and reliable peptide API supplier, we integrate regulatory intelligence into our operational fabric. We monitor evolving global requirements, ensuring our synthetic processes, analytical controls, and quality systems are not just compliant today, but are designed to adapt to the standards of tomorrow.

We partner with our clients by sharing relevant intelligence and collaboratively developing implementation strategies, thereby de-risking their regulatory submissions and ensuring a resilient, future-proof supply of high-quality peptide API. In an industry driven by innovation and governed by ever-changing rules, such a partnership is not just valuable—it is indispensable for long-term success.

Disclaimer

This article contains information, data, and references that have been sourced from various publicly available resources on the internet. The purpose of this article is to provide educational and informational content. All trademarks, registered trademarks, product names, company names, or logos mentioned within this article are the property of their respective owners. The use of these names and logos is for identification purposes only and does not imply any endorsement or affiliation with the original holders of such marks. The author and publisher have made every effort to ensure the accuracy and reliability of the information provided.

However, no warranty or guarantee is given that the information is correct, complete, or up-to-date. The views expressed in this article are those of the author and do not necessarily reflect the views of any third-party sources cited.