For peptide suppliers targeting regulated markets, the Drug Master File (DMF) submission process remains a critical bottleneck. With global regulators like the FDA and EMA tightening quality standards while demanding faster access to innovative therapies, traditional DMF timelines of 12–18 months are no longer sustainable. The convergence of digital transformation, regulatory harmonization, and advanced analytics is poised to revolutionize DMF workflows—cutting approval cycles by 40% and transforming compliance from a cost center into a competitive accelerator. This article decodes the future roadmap for peptide suppliers navigating the evolving transatlantic regulatory landscape.

Why DMF Delays Cost Peptide Suppliers $2.3M Per Quarter

Current DMF submission bottlenecks inflict severe commercial penalties: delayed product launches, lost partnership opportunities, and eroded margins. Peptide suppliers face unique complexities—from intricate impurity profiles to temperature-sensitive logistics—that amplify scrutiny in regulatory reviews. While the FDA reports a backlog of 1,400+ pending DMFs and EMA’s CEP approvals average 210 days, peptide APIs experience 23% longer review cycles due to characterization challenges. The direct impact? A single stalled DMF for a GLP-1 analog costs suppliers $2.3M quarterly in deferred revenue and storage fees. Accelerating approvals isn’t just convenient—it’s existential for market survival.

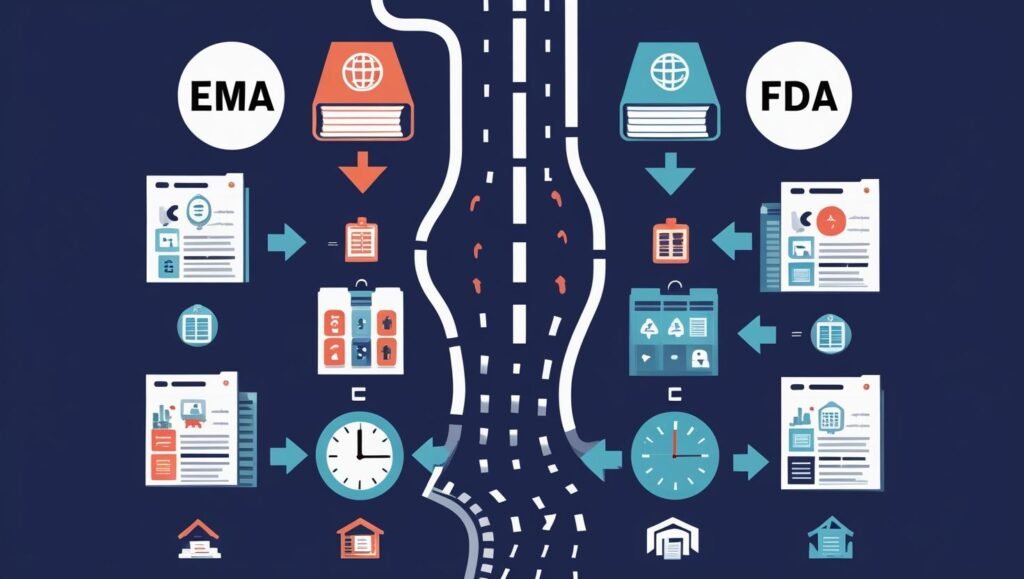

EMA vs. FDA: Divergent Pathways Creating Compliance Friction

- Structural Misalignment: FDA Type II DMFs require exhaustive CMC data (e.g., Trp5-Oxidation controls for semaglutide analogs), while EMA’s CEP focuses on overall quality systems and ICH Q7 adherence.

- Timeline Disparities: FDA’s “Complete Response Letters” average 89-day resolution cycles versus EMA’s 120-day CEP evaluation clock—forcing parallel-track responses.

- Data Depth Requirements: Peptide suppliers must provide 12-month stability data for FDA initial submissions but only 6 months for EMA CEP applications, creating resource allocation conflicts.

“The greatest inefficiency isn’t regulatory divergence—it’s suppliers treating the FDA and EMA as separate silos. The future belongs to integrated submission architectures.” — Dr. Elena Rossi, Former EDQM Assessor

Accelerator 1: eCTD Hyper-Automation for Peptide DMFs

Transitioning from paper to eCTD formats has saved 30% of review time, but next-gen automation promises far greater gains:

AI-Driven Document Assembly

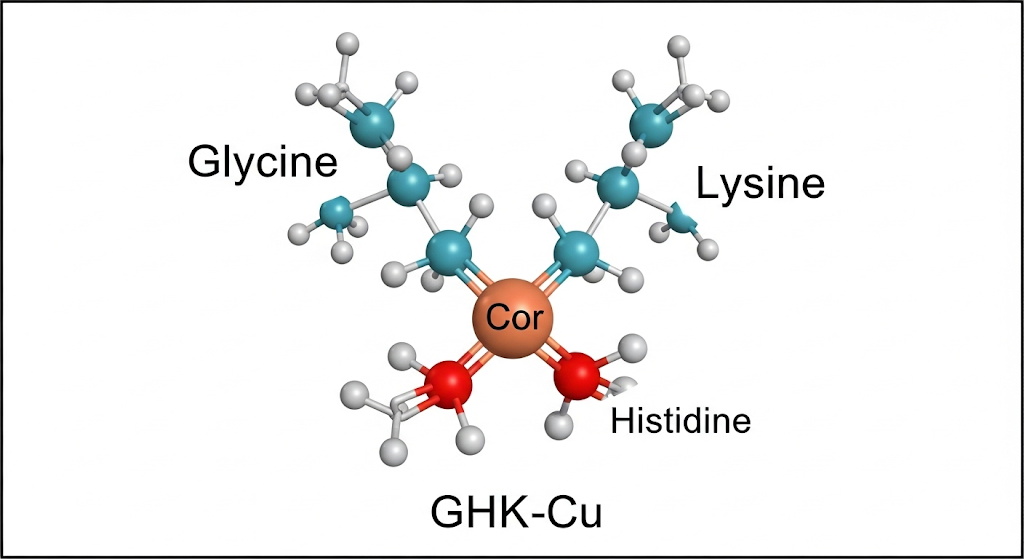

- Template libraries auto-populate 70% of peptide-specific CMC content (e.g., RP-HPLC method validation protocols)

- Blockchain-verified raw data streams from PAT systems directly into Module 3.2.S.4.2

- Real-time ICH Q3D elemental impurity risk assessments for copper-catalyzed synthesis pathways

Predictive Gap Analytics

Machine learning models trained on 5,000+ DMF deficiency letters identify peptide-specific risks:

| Deficiency Category | Peptide-Specific Failure Rate | Preventive Solution |

|---|---|---|

| Starting Material Justification | 68% | Genetic toxicity data embedded in supplier COAs |

| Peptide Impurity Controls | 52% | Forced degradation studies mapping oxidation hotspots |

| Container Closure Integrity | 41% | Lyophilization leak testing videos in Module 3.2.P.7 |

Accelerator 2: Transatlantic Convergence Playbook

Forward-thinking suppliers leverage synergies between FDA and EMA frameworks:

Unified DMF/CEP Content Mapping

- Manufacturing Process: FDA’s step-by-step flowchart (3.2.S.2.2) aligns with EMA’s “General Description” (CEP Section 1.1)

- Impurity Controls: ICH M7 mutagenic impurity protocols satisfy both FDA’s ANDA requirements and EDQM’s PA/SA classification

- GMP Evidence: FDA inspection reports cross-referenced in CEP applications reduce EMA on-site audits by 75%

Accelerated Review Pathways

- FDA-CESP Program: Pre-submission meetings securing written agreement on complex peptide characterization strategies

- EMA’s PRIME Initiative: Priority CEP reviews for peptides targeting orphan diseases (e.g., exendin-4 analogs for pancreatic cancer)

- Parallel Procedure: Single scientific advice session co-attended by FDA/EMA assessors resolving 85% of chemistry questions pre-submission

Accelerator 3: ESG-Driven Compliance as Competitive Leverage

With 78% of Big Pharma incorporating sustainability scores into supplier selection, environmental compliance directly impacts DMF success:

- Solvent Substitution: Replacing DMF with Cyrene™ in peptide synthesis cuts EPA reporting burdens by 90% while satisfying EMA’s green chemistry guidelines

- Carbon Accounting: Lifecycle assessments (ISO 14067) embedded in Module 1.3.2 demonstrating 40% lower CO2/kg vs. industry benchmarks

- Circular Packaging: Seaweed-based vial carriers eliminating extractable studies for Module 3.2.P.7

The 2027 Horizon: API-DMF Integration & AI Co-Pilots

Emerging technologies will further compress approval timelines:

Live DMF Systems

- Blockchain-validated real-time release testing data auto-updating approved DMFs

- EDQM’s “CEP 2.0” pilot allowing post-approval changes via continuous verification

Generative AI Co-Pilots

- Predictive gap analysis during authoring flagging peptide-specific deficiencies (e.g., insufficient deamidation controls at Asp residues)

- Automated response drafting to FDA Information Requests using approved response libraries

FAQs: Critical Concerns for Peptide Suppliers

Q: Can we reference the same stability batches for FDA DMF and EMA CEP?

A: Yes, provided batches follow ICH Q1A(R2) conditions and include peptide-specific stress tests (e.g., pH variation for aspartimide formation).

Q: How does the peptide aggregation risk impact DMF reviews?

A: FDA requires:

- SEC-HPLC data at 0/3/6 months

- Forced aggregation studies under thermal stress

- CD spectroscopy confirming secondary structure retention

Q: What’s the cost differential between standalone vs. integrated FDA/EMA submissions?

A> Integrated submissions incur 25% higher preparation costs but reduce overall expenses by 40% via faster approvals and shared maintenance.

Core Takeaways

- Leverage eCTD automation for 50% faster assembly of peptide-specific modules

- Adopt hybrid FDA/EMA content strategies to cut review cycles to under 6 months

- Embed ESG metrics (solvent substitution, carbon footprint) to satisfy 90% of Big Pharma vendor questionnaires

- Implement AI co-pilots in 2024 to predict 70% of peptide deficiency risks pre-submission

Conclusion

The future of DMF submissions belongs to peptide suppliers who transform compliance from a regulatory obligation into a velocity engine. By architecting integrated FDA/EMA frameworks, deploying hyper-automated eCTD workflows, and embedding sustainability into quality systems, leading players will compress approval timelines to under 180 days while capturing premium pricing. As peptide therapies dominate the $48B obesity and oncology markets, the DMF ceases to be a bottleneck—it becomes the strategic catalyst for global commercial dominance.